When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

In this modern world driven by technology, banks are optimistic about keeping up with the demands of technology and customer expectations. With traditional systems, banks need help with slow processes, inefficiency and outdated models that can frustrate customers and employees alike. However, AI offers a promising solution, promising to revolutionize how banks operate, from speeding up transactions to offering more personalized customer services. A report by McKinsey suggests the potential of AI in banking and finance would grow as high as $1 trillion.

Furthermore, recent surveys of IT executives in banking found that 85% have a clear strategy and knowledge of AI technologies for adopting AI development of new products and services.

In this article, you will explore the use of AI in banking, the benefits of AI in banking, and real-life strategies banks are employing to integrate AI effectively that have helped industry professionals and technology enthusiasts understand the potential and pitfalls of AI integration.

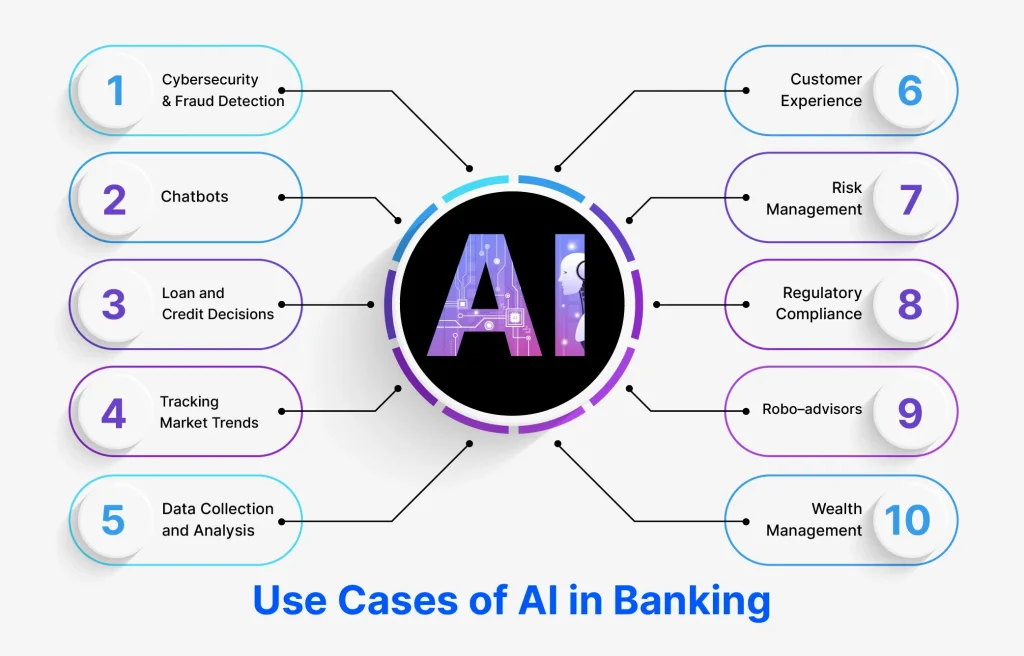

Banks and other financial institutions can adopt various approaches for setting up their generative AI (gen AI) operating models, ranging from highly centralized to highly decentralized configurations. Here are some of the AI applications in banking:

There are many AI use cases in banking but the most important is for the major challenge of banks facing threats from fraud and cyber-attacks due to the numerous online transactions they process daily. AI has emerged as a powerful tool to combat fraud, with 58% of banks using AI for fraud detection. Danske Bank’s deep learning tool identifies fraudulent activities efficiently and minimizes false positives, enhancing overall security. The EIU survey of banking IT executives reveals fraud detection using AI in banking as the top application in the sector, reducing losses, improving resource efficiency, and enhancing customer experience. Mastercard uses data on transactions and authorizations to predict fraud more accurately, and AI also predicts credit risk and personalized services.

AI in digital banking has increased customer expectations for round-the-clock service. Chatbots provide near-instantaneous responses to customer queries by analyzing customer data, such as transaction history and spending patterns, to provide personalized recommendations to customers. The application of conversational AI in banking can address this need by providing 24/7 customer service. These AI systems continuously learn from customer interactions, improving their ability to offer personalized assistance and streamline customer communication, as demonstrated by Bank of America’s Erica.

Traditional methods of assessing creditworthiness are often limited to credit scores and history. It may not accurately reflect a borrower’s real financial behavior. The role of Artificial Intelligence in banking demonstrates exceptional effectiveness in credit risk management. For instance, the US-based FinTech company Zest AI achieved a remarkable 20% reduction in losses and default rates by leveraging AI for credit risk optimization. AI in banking, through predictive analytics and machine learning, can assess the patterns and behaviors of customers, even those with limited credit histories, to make more informed and fair credit decisions.

Advanced neural networks in AI can process vast amounts of data to detect market trends and sentiment. This capability allows banks to make quicker, data-driven decisions on investments, enhancing their responsiveness to market changes and opportunities. For instance, if AI predicts an upcoming recession, investors may shift their investments to more defensive sectors to mitigate potential losses.

The enormous volume of transactions processed daily by financial institutions makes manual data handling impractical. AI, particularly through deep learning technologies, aids in the accurate collection and analysis of data, thereby improving efficiency and reducing the likelihood of errors, which is crucial for both regulatory compliance and customer satisfaction.

Generative AI in banking is revolutionizing customer interactions in banking by automating processes such as KYC and account setup. This not only speeds up the process, reducing the time customers need to spend on banking tasks but also ensures accuracy and compliance with regulatory standards. This dynamic process allows banks and financial institutions to anticipate customer needs, prevent fraud, and AI enhance customer experience.

The banking sector is highly susceptible to external risks like economic fluctuations and political instability. AI for banking supports risk management by providing analytics that predict potential future disruptions, allowing banks to make proactive decisions to mitigate risks. For example, AI can analyze news articles about a particular industry or company and identify potential risks, such as legal issues or reputational damage. Banks and financial institutions can proactively identify and mitigate potential compliance issues by automating risk management.

The ever-changing landscape of regulatory compliance in banking can be difficult to manage manually. AI and machine learning streamline compliance by automating the analysis of new regulations and improving the accuracy and efficiency of compliance processes, thus reducing operational risks and costs.

Robo-advisors, using AI algorithms, offer automated investment management with advice to clients, managing portfolios and providing tax optimization. Platforms like Wealthfront and Betterment disrupt traditional wealth management by offering cost-effective, accessible investment solutions.

In wealth management, AI is enhancing the investor experience by optimizing portfolios, analyzing market sentiment and events, and generating risk profiles for traders. Investment managers are also increasingly using AI and automation to mine large amounts of qualitative and unstructured data needed for environmental, social, and governance (ESG) scoring.

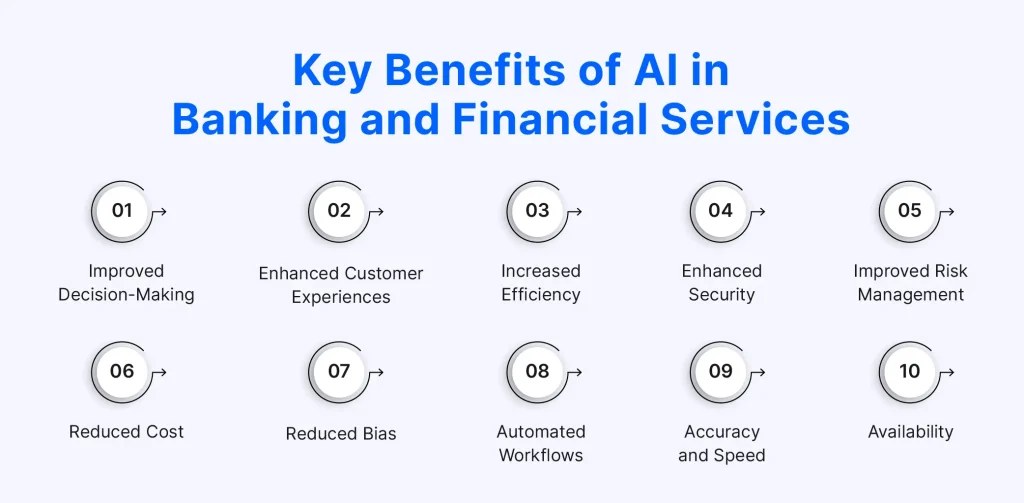

AI is revolutionizing the banking and financial services industry, offering substantial improvements across various operational and customer service dimensions. Here’s a simplified breakdown of the key benefits AI brings to the sector:

AI enhances banking operations by providing real-time data analysis, which sharpens investment strategies and credit assessments. AI for decision making not only minimizes financial risks but also opens up new business opportunities. Financial institutions leveraging AI can navigate the complex financial landscape with greater precision, ensuring sound decisions that bolster profitability and risk management.

AI-powered chatbots and virtual assistants deliver 24/7 customer service, responding instantly to client inquiries. This constant availability and personalization greatly improve customer satisfaction by providing quick and convenient support, fostering stronger relationships and loyalty.

AI streamlines numerous banking processes, including compliance checks, loan underwriting, and fraud detection, reducing both time and costs. By automating these routine tasks, AI allows staff to focus on more strategic activities, enhancing overall productivity and service quality.

Approximately 33% of AI applications are designed to improve financial security, implementing sophisticated encryption methods that protect sensitive data from cyber threats. These AI systems continuously update their protocols to counter new security challenges, ensuring robust protection for customer information.

AI algorithms integrate and analyze data from various sources, including customer behavior, market trends, and economic indicators. This comprehensive analysis helps identify potential risks early, enabling proactive risk management strategies that secure assets and stabilize the financial landscape.

AI-driven marketing strategies and customer service tools not only enhance engagement but also cut costs by optimizing resource allocation. For example, AI chatbots handle routine customer queries, reducing the need for extensive human customer service teams and thereby lowering operational expenses.

AI systems in banking mitigate biases in credit scoring by relying solely on financial data rather than personal demographics. This fairer, data-driven approach promotes equality in financial services, ensuring that all customers are assessed based on their financial behavior without prejudice.

AI automation simplifies banking workflows, boosting efficiency and accuracy in operations from accounts management to customer service. This automation is expected to save the banking industry significant sums by reducing the reliance on manual processes.

AI in the banking industry significantly enhances the precision and speed of financial operations. By automating data processing and analysis, AI reduces human errors and accelerates the delivery of insights, which is crucial for timely decision-making in the fast-paced financial sector.

AI systems, particularly when hosted in the cloud, offer seamless and continuous service, ensuring that customer needs are met promptly at any time. This constant availability enhances the overall customer experience, making banking more accessible and convenient.

The application of AI banking is not merely a futuristic concept but a present-day tool revolutionizing how banks operate and interact with their customers. Here are some of real-life AI in banking examples of implementation to overcome traditional banking challenges.

JPMorgan Chase has developed an early warning system using AI and deep learning to detect malware, trojans, and phishing attempts. This system shortens response times by alerting the cybersecurity team about 101 days in advance. Furthermore, JPMorgan Chase is investing $12bn annually in technology, including AI and machine learning, making it an industry leader. The bank has also introduced an AI-powered virtual assistant and an AI research program and launched a climate change fund using an AI-driven tool, ThemeBot, to pick stocks in companies transitioning to low carbon emissions.

Capital One employs its intelligent virtual assistant, Eno, to provide personalized banking services. Eno is part of a broader initiative that includes the use of virtual card numbers to combat credit card fraud and projects aimed at enhancing AI’s capability for creative problem-solving and explainability.

The banking sector is adopting artificial intelligence (AI) to enhance efficiency, service, productivity, and reduce costs. They are exploring new approaches for setting up their generative AI models, ranging from highly centralized to highly decentralized configurations.

According to a report by Business Insider, nearly 80% of banks are aware of the potential advantages of AI in banking. This indicates a strong recognition within the industry of AI’s capacity to transform traditional banking operations and services.

Furthermore, new research from economists suggests that AI is not just facilitating incremental improvements but is also opening up transformational opportunities for product innovation and the development of new business models. This positions AI as a game-changer in the banking industry, with the potential to significantly alter how financial services are structured and delivered in the future. Thus, these numbers indicate that the banking and finance sector is rapidly adopting AI to enhance efficiency, service, and productivity, and reduce costs.

The future of AI in banking and financial services is promising, with rapid advances in technology and data availability allowing banks to drive business growth, improve customer experiences, and reduce risks. AI-powered chatbots and virtual assistants can provide personalized financial advice and support, enhancing customer journeys. AI can also play a significant role in risk management by detecting and preventing fraudulent activities, reducing errors, and enhancing overall security. It can also analyze customer data to identify potential risks, such as customers at risk of defaulting on loans or credit cards.

AI is expected to improve efficiency and reduce costs by automating manual processes, such as document underwriting and compliance checks. It can streamline operations, optimize workflows, and reduce human intervention, freeing up resources for other critical tasks. Loan underwriting is another example of AI’s potential, as it can automate credit checks and approvals, reducing the time and costs associated with manual processes. AI can also identify opportunities for cross-selling and upselling, allowing banks to offer additional products and services that better meet customer needs.

AI development plays a transformative role in optimizing banking and finance operations. A comprehensive, enterprise-ready platform empowers businesses to develop and implement applications tailored to their specific operational requirements.

IntellicoWorks is a leading AI development company helping banks solve challenges such as complex risk assessment, time-consuming data analysis, and personalized customer interactions are prevalent. We offer AI development solutions to eliminate risk management within the finance and banking sector by automating labor-intensive tasks and enhancing the efficiency of risk assessment processes. Leverage AI development services to gain a competitive edge and enhance your organization’s success in the dynamic landscape of finance and banking.

AI and banking together can bring multiple benefits. 60% of financial services companies have implemented at least one AI capability to streamline the business process. This shows the future promise of AI in fintech and banking. AI is set to revolutionize the banking landscape with operational efficiency, risk management, customer experiences, and decision-making processes. Machine learning algorithms and data analytics enable banks to analyze vast amounts of data in real-time, identifying patterns and trends to mitigate risks. AI chatbots and virtual assistants improve customer interactions and streamline transactions. AI’s contribution to fraud detection and prevention protects banks and customers from fraudulent activities. The future of AI in banking promises further innovation and competitiveness in the digital landscape. Thus, all banking institutions must invest in AI solutions to offer customers novel experiences and excellent services.

Enhance Security, Efficiency, and Customer Service with AI in Banking!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.