When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

Allied Market Research estimates that the market for artificial intelligence (AI) in banking would be worth $160 billion in 2024 and $300 billion by 2030. This explosive expansion is evidence of the vital role AI and ML play in controlling credit risk and advancing financial technology.

Worldwide, 1.5 billion individuals lack access to banking or other financial institution services. We refer to these people as “unbanked.” Less than half of those who have bank accounts are eligible for lending to the rest of us. It is clear that more intelligent credit scoring methods are needed to increase banks’ capacity to provide loans.

Credit scoring powered by AI is the most relevant and promising approach. Credit scoring assesses a bank customer’s ability and willingness to repay debt. Decisions on credit scores made by AI are based on information like this:

A mathematical model based on statistical techniques and computations for a substantial amount of data is represented by scoring.

An AI credit score refers to a numerical representation of an individual’s creditworthiness, calculated through advanced algorithms and machine learning techniques rather than traditional methods employed by credit bureaus. This innovative approach leverages vast datasets to assess various factors influencing creditworthiness, such as payment history, debt levels, length of credit history, and types of credit accounts.

The significance of AI credit scoring lies in its ability to provide more accurate and timely assessments, potentially expanding access to credit for individuals who may have been overlooked or underestimated by conventional scoring models. By analyzing a broader range of data points and patterns, AI algorithms can identify subtle indicators of credit risk that traditional methods might miss, leading to fairer evaluations for consumers.

Credit AI is an artificial intelligence technology applied in the credit industry, meant to assess human creditworthiness or an entity, predict the risk of credits, and improve decision-making on giving out credit. Some of the basic working functions of the Credit AI systems include processing huge data, recognizing the pattern, and making a decision on the basis of that analysis.

At the core of Credit AI is machine learning: a subset of AI in which algorithms derive patterns from past data to make future behavior predictions. For example, based on past loan repayment history, buying behavior, and even activity on social media, AI models could aid in the assessment of whether a borrower tends to default. For this process, full-jsoned datasets are used to train the models, including features of payment history, utilization of credit, and length of history of using credit.

One such capability is “Credit AI,” which will also cover NNLP capabilities to come up with a clearer picture of borrowers’ financial habits and reliability by analyzing textual data, such as various customer service interactions or borrowers’ posts made on social media. AI in credit scoring will also be ajsonl a great tool in detecting fraud and stopping the same, as any abnormal pattern in the usage of credit, by significantly deviating from individual behavior, will get noted.

Furthermore, Credit AI democratizes access to credit by enabling more personalized and accurate credit scoring. This assumption aside, traditional credit scoring methodologies are either biased or myopic, assuming they take the full spectrum of an individual’s financial behavior into account.

AI algorithms will, however, be in a position to factor in alternative data points—like rental and utility payment histories, or even behavioral data points—and will be able to give a more holistic and equitable view into potential borrowers’ creditworthiness. Summing this all up, Credit AI is seen to revolutionize the financial space with sophisticated, data-driven insights in credit evaluation that may increase the accuracy of credit decisions and potentially increase the availability of credit across some demographic. The systems of the Credit AI will continue learning, changing,json and growing. So, with more system development, better, reliable, and strong credit assessment will be enabled.

Artificial Intelligence Credit Scoring works on the basis of some very sophisticated algorithms that ensure more numbers of verifications are being done on an individual’s credit score. Scoring under artificial intelligence is really important for the modern credit score systems, as it fully revolutionizes the way lending companies have been going about determining the credit competitiveness of somebody. The following are some of its key benefits:

AI algorithms review these mammoth datasets with intricate patterns to allow for more perfect precision in evaluating credit risk. AI models take a much wider set of considerations and interactions into account, allowing for the identification of subtle signs of creditworthiness or risk that were previously ignored by the classical approach.

The AI-based credit-scoring models are the ones who do use machine learning techniques with the ability to learn and adjust to changing trends in consumer behavior. This, therefore, makes the predictive power for the credit scoring model higher in predictive ability, for instance, allowing a lender to make more informed decisions concerning lending risks and potential defaults.

And while traditional credit scoring methodologies rely principally on credit bureau data, AI-driven models can take into account a whole host of alternative sources of data. These may include information from social media, online transactions, and utility payments to even smartphone usage patterns. Another benefit would be it enables the merging of different sources of data with the process, enriching the assessment with more information on the financial behavior of an individual.

AI algorithms can then customize the credit scoring model for each and every borrower based on individualistic financial conditions and life situations. This prepares an individualized approach that thwarts inherent biases by one-size-fits-all scoring systems. Lastly, the AI models can be designed to be able to find and reduce the biases, thus ensuring that the model outputs in credit decisions are based on objective criteria.

The most important advantages of using AI-based credit scoring systems are that they reduce, in a humongous manner, the amount of time required for the appraisal of loans. These will help in smoothing the workflows, saving manual work and helping lenders to provide faster responses to applicants, ultimately benefiting customers in an increase in the level of experience and satisfaction.

AI-based credit scoring differs from traditional models in several key ways:

Traditional credit-scoring models are generally based on structured data from credit bureaus, including payment history, outstanding debts, and length of credit history. In contrast, AI-powered models can access a broader array of data sources, potentially including alternative data like utility payments, rental history, social media activity, and smartphone usage patterns. This capability allows for a more nuanced and accurate evaluation of an individual’s creditworthiness.

AI algorithms can delve into extensive datasets to discern complex patterns and relationships that might elude traditional models. Utilizing machine learning, AI models can detect subtle signals of credit risk and adapt to evolving consumer behaviors over time.

AI-based scoring models typically demonstrate superior predictive ability compared to traditional models. They can more effectively ascertain an individual’s likelihood of default or delinquency by analyzing a wider array of factors and their interconnections, yielding more dependable credit assessments.

AI-driven credit scoring systems streamline the decision-making process, accelerating and enhancing the efficiency of loan evaluations. By automating procedures and eliminating manual tasks, these systems can expedite lenders’ responses to loan applications, thereby improving the customer experience.

AI can tailor credit scoring models to each borrower’s specific financial circumstances and spending behaviors, enhancing fairness. This individualized approach counters the biases inherent in generic scoring systems and enables lenders to make more nuanced decisions.

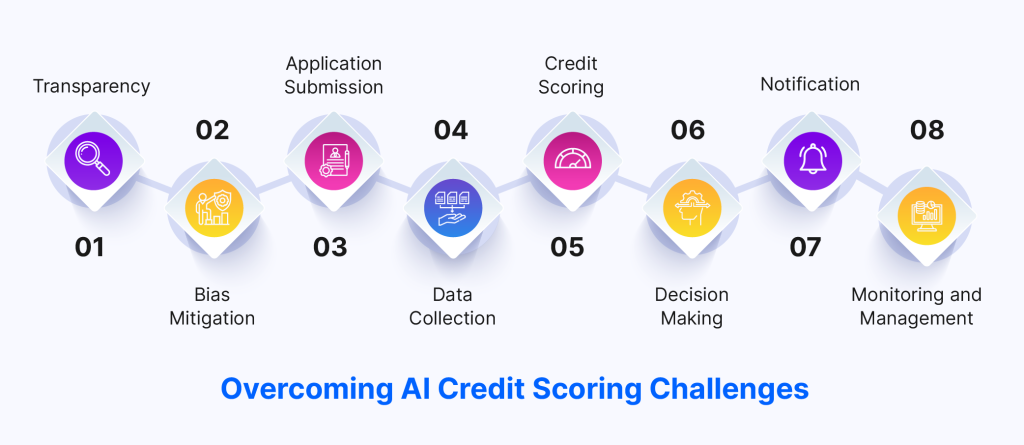

Overcoming AI challenges related to transparency and bias mitigation is crucial for the successful implementation of AI credit scoring systems. Here are some strategies to address these issues:

Develop AI models that provide transparent explanations for their credit scoring decisions. Techniques such as model interpretation algorithms and feature importance analysis can help users understand how the model arrives at a particular score.

Ensure that lenders and credit scoring agencies disclose the factors and data sources used in their AI models. Providing clear information about the input variables and their relative importance can enhance transparency and accountability. Adhere to regulations such as the General Data Protection Regulation (GDPR) and Fair Credit Reporting Act (FCRA), which mandate transparency in credit scoring practices. Compliance with these regulations ensures that individuals have visibility into how their data is used for credit assessment.

Make that the training data for AI credit scoring models is representative of the population being evaluated and diverse. Biases can be minimized by combining data from various socioeconomic and demographic backgrounds.

To find and reduce biases in AI credit rating algorithms, conduct routine audits. To reduce discriminatory results, apply fairness restrictions or metrics while training the model. Disparate impact analysis, equalized odds, and demographic parity are some strategies that can be used to guarantee that everyone is treated fairly.

The process begins when an individual applies for credit, such as a loan, credit card, or mortgage. The applicant provides personal information, including their name, address, social security number, income, employment history, and details about the requested credit.

Lenders obtain pertinent information from a variety of sources regarding the applicant’s credit history and financial practices. To do this, you usually have to get credit reports from one or more of the big credit agencies (TransUnion, Equifax, and Experian). These reports include details on the person’s credit accounts, payment history, unpaid debts, and public records like liens and bankruptcies.

Based on the data gathered, lenders evaluate an applicant’s creditworthiness using credit scoring models. Conventional credit scoring models use variables like payment history, credit utilization, length of credit history, types of credit accounts, and recent credit queries to issue numerical scores (e.g., FICO Score, VantageScore). In order to create credit ratings, AI-based credit scoring models may use machine learning algorithms and various data sources.

Based on the credit score and other relevant factors, the lender makes a decision regarding the applicant’s credit application. This decision may involve approving the application, denying it, or offering credit with specific terms and conditions, such as interest rates and credit limits.

The decision of the lender is communicated to the applicant, typically via letter, email, or an online portal. The applicant gets information about the authorized credit terms if they are accepted. If the application is rejected, a note outlining the reasons—which could include things like a lack of credit history, excessive debt, or a poor payment history—is sent to the applicant.

The borrower has the responsibility for prudent credit management, on-time payments, and upholding a favorable credit standing for credit accounts that have been authorized. When evaluating a borrower’s continued creditworthiness and modifying credit terms, lenders may evaluate the borrower’s credit profile on a regular basis.

The benefits of AI Credit Scoring include enhanced accuracy, faster decision-making, expanded data sources, personalized assessments, and continuous improvement capabilities. AI credit scoring provides several advantages over conventional credit scoring methods:

Utilizing AI-powered solutions has several benefits, one of which is speed. Conventional approaches to credit risk management frequently rely on labor-intensive, error-prone manual procedures.

Conversely, AI-powered solutions allow businesses to make decisions more quickly and intelligently by analyzing vast amounts of data in real-time.

Risk evaluations made possible by AI-powered systems are also more accurate. These systems can spot patterns and trends that human analysts might miss by examining a large variety of data sources, including demographics, credit scores, and transaction history.

This lowers the chance of default and enhances portfolio performance by enabling businesses to forecast future credit risk more precisely.

The enhanced efficacy of AI-powered solutions in detecting fraudulent activity is an additional benefit. These technologies can swiftly spot suspicious activity and flag it for additional investigation using real-time transaction data analysis. By preventing fraudulent transactions before they happen, this helps businesses reduce the chance of suffering financial losses.

Lastly, by giving more customized credit offers, AI-powered solutions can improve the client & customer experience. These technologies allow credit offers to be customized to the specific requirements and preferences of each individual consumer by evaluating customer data, including credit history and spending patterns. This might raise client loyalty and satisfaction levels, which would eventually boost the company’s financial success.

Selecting Intelicoworks provides a holistic solution supported by knowledge, creativity, and a customer-centric approach when looking for AI development services. Our team is made up of seasoned experts in machine learning, artificial intelligence, and data science who are committed to providing innovative solutions that are customized to meet your unique requirements.

You may take advantage of tailored AI solutions with IntelicoWorks that are made to meet your specific company goals and issues. Whether you need computer vision, natural language processing, predictive analytics, or other AI applications, we have the knowledge and experience to create solid solutions that produce noticeable outcomes.

To make sure that our AI solutions are at the forefront of innovation, we make use of cutting-edge technology and algorithms. Moreover, AI development services encompass a range of solutions tailored to harness the power of artificial intelligence for various applications and industries. Our track record speaks for itself, with a history of successful AI projects across various sectors, including finance, healthcare, retail, and manufacturing. We approach each project with a focus on quality and efficiency, adhering to industry best practices and standards to ensure that our solutions meet and exceed your expectations.

Credit risk management of the future is envisioned as autonomous systems, where artificial intelligence (AI) will play a bigger role in decision-making without human interference. Real-time analysis of greater data quantities and faster, more accurate decision-making are two benefits of using machine learning algorithms.

The elimination of prejudice and human mistake may result in more impartial and consistent judgments, which is one possible advantage of autonomous credit risk management. These systems may also adjust over time and pick up new information, which increases their efficacy and accuracy.

Enhance Your Credit Scoring Models with Our AI Development Expertise.

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.