When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

Banking chatbots are AI-powered virtual assistants designed to interact with users in the banking sector. These chatbots use natural language processing (NLP) and machine learning algorithms to understand and respond to user queries and commands in a conversational manner. They operate within messaging platforms, mobile apps, or websites, providing a seamless and interactive experience for customers.

Chatbots offer 24/7 assistance, addressing customer queries related to account information, transactions, and general banking services. They can handle routine inquiries, providing quick and accurate responses. Users can initiate various banking transactions, such as fund transfers, bill payments, and account management, through the chatbot interface. The chatbot guides users through the necessary steps, making the process more user-friendly.

Since the middle of the 2010s, the trend of AI-powered banking has been gaining traction. The way financial institutions communicate with their clients is changing as a result of conversational AI. According to a source, the conversational AI industry is projected to increase from USD 10.7 billion in 2023 to USD 29.8 billion in 2028. Banks all across the world are making extensive use of conversational finance as AI and machine learning technology become more accessible.

Conversational AI presents a unique potential for banks and their clients since it lowers operating expenses and ensures prompt, effective service around the clock. For banks, the emergence of generative AI models like ChatGPT is a major factor driving conversational AI since it indicates that these technologies are getting more accessible. Financial services conversational AI uses a variety of different technologies. Let’s take a quick look at a few of them:

This technology’s algorithms are able to comprehend user inquiries and provide conversational responses. NLP algorithms continue using the conversation’s content to forecast client satisfaction levels and provide a solution to this dilemma. Legal texts can also be automatically read and interpreted by NLP.

Technologies quickly segment and evaluate data. They are therefore useful for client base segmentation, fraud detection, and credit scoring.

Now, voice commands can be used for all actions by customers. Furthermore, service quality and compliance can be enhanced with the use of automated call analysis. Voice authentication solutions give people who might have trouble using standard interfaces access to services and increase the security of banking transactions.

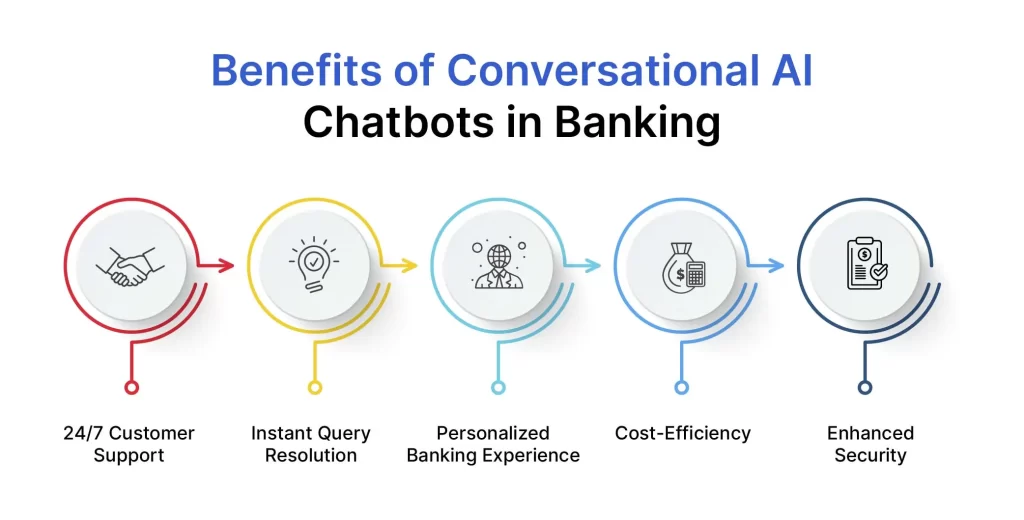

Let’s delve into the benefits of AI in banking and diverse use cases that highlight the significant role of Conversational AI in the banking sector.

Conversational AI ensures round-the-clock customer assistance, addressing queries, and providing information irrespective of time zones. This not only enhances customer satisfaction but also contributes to a positive brand image.

Chatbots excel in providing quick responses to customer queries, facilitating faster issue resolution, and reducing customer wait times. This efficiency leads to improved customer experiences and loyalty.

Conversational AI leverages customer data to offer personalized recommendations and solutions. This customization enhances the overall user experience, making interactions more meaningful and relevant to individual preferences.

Implementing chatbots significantly reduces operational costs associated with customer support. Automated responses and issue resolutions free up human resources for more complex tasks, optimizing resource allocation.

Conversational AI ensures secure transactions by implementing advanced authentication processes. Multi-factor authentication and secure data encryption contribute to safeguarding sensitive customer information.

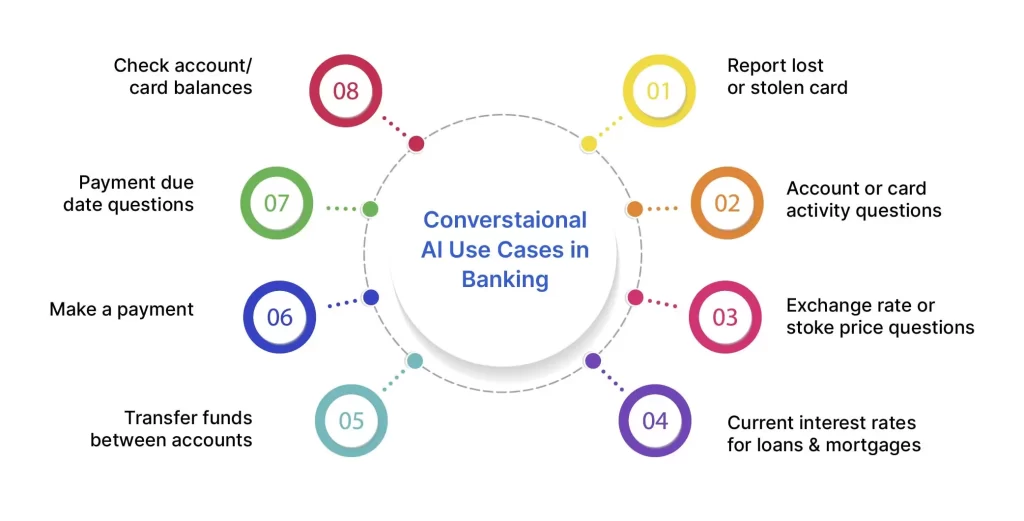

Conversational AI has become a cornerstone in reshaping the landscape of the banking industry, introducing innovative solutions to enhance customer experiences and streamline operations. From personalized interactions to efficient transaction processing, the use cases of Conversational AI in banking are diverse and impactful.

Inquiries concerning account balances, transaction histories, and other common questions that customers would normally have to contact customer support or log into a mobile app for if conversational banking wasn’t available are answered by the conversational AI. Without requiring human assistance, conversational AI can respond to common questions concerning loan applications, interest rates, account kinds, and other topics.

Customers benefit from this since it frees up banking experts from tedious responsibilities. Human contacts can thus be set aside, especially for challenging, one-of-a-kind questions that call for a specialist’s assistance.

Conversational AI facilitates frictionless transaction processing. Users can initiate fund transfers, pay bills, and perform various banking transactions through a conversational interface. This not only simplifies the user experience but also accelerates the transaction process, reducing the need for users to navigate through multiple banking channels.

First impressions matter in the digital age, and chatbots are adept at making an impression. Through dynamic, real-time chats, these astute bots learn what makes customers tick.

The sales team receives this valuable information from the chatbot and proceeds accordingly. Therefore, chatbots serve as both an introduction to the bank and a starting point for a more in-depth, tailored conversation with potential customers.

Ensuring the security of financial transactions is paramount in the banking sector. Conversational AI contributes to fraud prevention by monitoring transactions and swiftly detecting any suspicious activities. In the event of potential threats, chatbots can immediately notify customers, allowing for timely intervention and safeguarding against financial risks.

Conversational AI tools have found extensive applications in the banking sector, transforming the way financial institutions interact with their customers. Here are examples of some notable conversational AI tools tailored for banking:

The most widely used conversational AI in banking is the chatbot. Erica from Bank of America is one such. This chatbot provides every possible artificial intelligence option for conversational banking. Alerts and notifications, payment planning, balance checks, and personal financial assistance are just a few of Erica’s capabilities.

Artificial intelligence is used by smart money and financial advisor applications like Plum to provide you with investment and financial advice based on individual traits. These advisers have a chatbot-like interface, but their algorithms are mostly focused on financial forecasting. These applications are also known as wealth management chatbots. They offer stock recommendations and assess risks.

With so many conversational AI options for financial services on the market, a tech partner like Binariks can aid in creating and customizing voice assistants and chatbots for your banking needs.

IBM Watson Assistant is a powerful conversational AI platform that enables banks to build chatbots capable of natural language understanding. It facilitates personalized interactions, helping customers with account inquiries, and transaction history, and even guiding them through complex processes like mortgage applications.

IntellicoWorks specializes in providing cutting-edge AI chatbot development services, crafting intelligent virtual assistants tailored to meet diverse banking business needs. Our expert team connects the power of artificial intelligence to create chatbots that seamlessly engage with users, offering real-time support, streamlining processes, and enhancing overall user experiences. From intuitive conversational interfaces to personalized interactions, our AI chatbots are designed to elevate customer satisfaction and operational efficiency. Hold the future of communication with IntellicoWorks, where innovation meets expertise in delivering transformative AI chatbot solutions for your business.

Conversational AI chatbots have become indispensable in the banking sector, offering a myriad of benefits and reshaping customer interactions. As technology continues to advance, the role of these intelligent assistants will likely expand, further enhancing the efficiency and effectiveness of banking operations while delivering superior customer experiences. Embracing Conversational AI is not just a trend but a strategic move towards a more connected, responsive, and customer-centric future in banking. The fintech market will never be the same if conversational AI becomes widely used. The simplicity with which contemporary financial transactions are conducted nowadays is beyond our wildest dreams. The role of chatbots in banking extends beyond transactional tasks, providing users with a user-friendly interface for account management and financial inquiries

Without a question, the technology that has made our lives easier is conversational AI for banking, which enables us to manage our money with a single smartphone click. In addition to the obvious advantages—such as lowering operating costs through automation and relocating resources for banks—conversational banking increased our faith in banks by providing better service convenience.

Ready to Upgrade Your Banking Services? Unlock the Potential of AI Chatbots Today!

Follow IntellicoWorks for more insights!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.