When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

By2025, it is predicted that there will be 163 zettabytes of data in the globe, 80 percent of which will be unstructured. Investors who can access even a small portion of this data would be able to make highly educated investment decisions by gaining insightful, practical knowledge.

In order to map performance, sentiment, and trends in the market and find companies that are ready for equity investment, some investors are investigating data mining. Traction may be detected by tracking media footprint, social media activity, app downloads, domain authority, and website traffic. In order to rank businesses, AI systems can intelligently sort through vast amounts of organized and unstructured data to find correlations and trends. These algorithms are becoming more effective and able to handle larger amounts of data thanks to developments in machine learning.

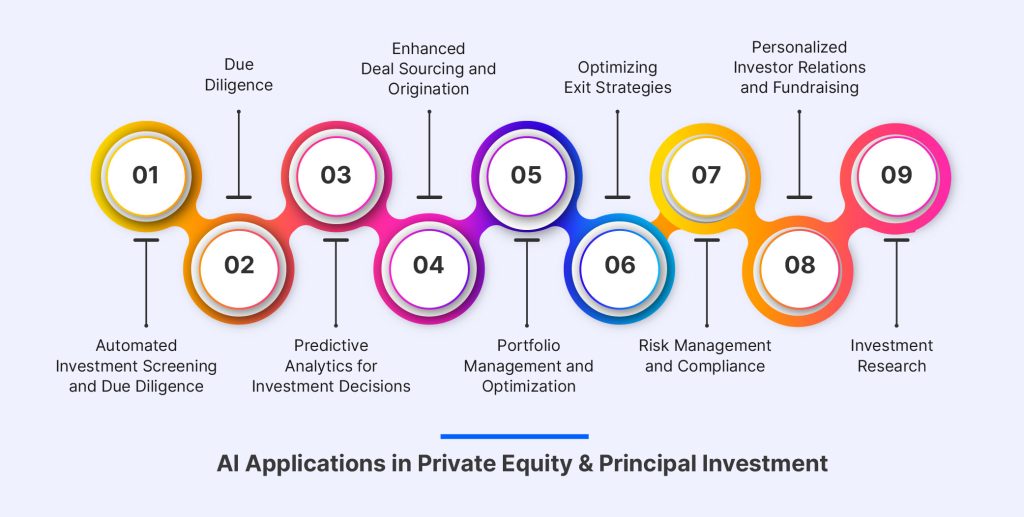

Artificial intelligence (AI) is becoming a more attractive option for major investment firms and private equity organizations looking to obtain a competitive edge in the fast-paced, data-driven financial market of today. Numerous uses are available for this revolutionary technology across the investment lifecycle, ranging from portfolio management and exit strategies to transaction discovery and due diligence. This essay will examine the several applications of AI in principle investment and private equity, emphasizing the revolutionary ways in which it is transforming risk management, decision-making, and wealth creation.

“AI equity” can refer to a couple of different concepts depending on the context.

This refers to fairness, accountability, transparency, and inclusivity in the development, deployment, and use of artificial intelligence (AI) systems. It focuses on ensuring that AI technologies do not perpetuate biases, discrimination, or inequality and that they benefit all individuals and communities equitably.

This refers to investments made in companies that develop, utilize, or provide AI technologies and solutions. Equity investors typically purchase ownership stakes in these companies in exchange for a share of their profits and have a vested interest in their success and growth. These investments can range from venture capital funding for early-stage startups to private equity investments in more mature AI companies.

AI may remove 85 million jobs by 2025, but it may also generate 97 million new ones, adding 12 million jobs overall. The financial industry is undergoing a significant transformation with the rise of artificial intelligence (AI). Traditionally, financial institutions relied heavily on manual processes and human expertise to analyze data, make investment decisions, and manage risk. However, the advent of AI technologies has revolutionized these practices, enabling faster and more accurate decision-making processes.

One of the key drivers behind the adoption of AI in finance is its ability to process vast amounts of data at unprecedented speeds. AI algorithms can analyze market trends, economic indicators, and consumer behavior patterns in real-time, providing valuable insights for investment strategies. Moreover, AI-powered predictive analytics can forecast market movements and identify potential risks, allowing financial professionals to make informed decisions with greater confidence.

Another area where AI is making a significant impact is in risk management. By leveraging machine learning algorithms, financial institutions can identify and mitigate potential risks more effectively. AI can analyze historical data to detect anomalies and patterns that may indicate fraudulent activities or market fluctuations, enabling proactive risk management strategies. Moreover, AI drone technology enables autonomous navigation, real-time object detection, and precision monitoring, revolutionizing applications ranging from aerial surveillance to delivery services.

Overall, the rise of AI in the financial industry is reshaping how investment decisions are made, risks are managed, and customer experiences are enhanced. As AI technologies continue to evolve, we can expect further innovations that will drive greater efficiency, transparency, and profitability across the financial sector.

The major investment and private equity sectors are undergoing radical change due to artificial intelligence. Large volumes of data can be processed fast and correctly, which helps businesses make better decisions, run more efficiently, and make smarter investments.

AI-driven lead generation and personalization techniques enable private equity firms to identify and engage with potential investors more effectively. By analyzing vast datasets of investor preferences, behaviors, and historical interactions, AI algorithms can segment and target prospects with personalized communication and tailored investment offerings. This personalized approach enhances investor engagement, fosters trust, and ultimately drives fundraising success.

AI empowers investment professionals with advanced private equity analysis tools and predictive modeling capabilities. By analyzing historical financial data, market trends, and macroeconomic indicators, AI algorithms can generate insights into potential investment outcomes and risks. This data-driven approach enables more informed investment decisions, allowing firms to optimize their investment strategies and maximize returns while minimizing risks.

AI plays a crucial role in optimizing exit strategies for private equity investments. By analyzing market dynamics, competitor landscapes, and consumer behavior patterns, AI can identify optimal timing and exit channels for portfolio companies. Additionally, AI-powered predictive modeling can forecast future market conditions and guide strategic decisions regarding divestment or exit, ultimately maximizing returns for investors.

AI enables private equity firms and principal investors to automate the screening of potential investment opportunities and streamline the due diligence process. By leveraging machine learning algorithms, vast amounts of data from diverse sources can be analyzed rapidly to identify promising targets and assess their viability. This automation not only accelerates decision-making but also enhances accuracy by reducing human error and bias.

AI is increasingly revolutionizing private equity and principal investment practices, offering a plethora of innovative use cases and applications that enhance decision-making, streamline processes, and maximize returns. Moreover, AI-powered facial recognition technologies aid in verifying identities during transactions, ensuring compliance, and safeguarding against fraudulent activities, thereby optimizing decision-making and maximizing returns for investors. Here are some key AI use cases and applications in this domain:

Artificial Intelligence has the potential to revolutionize the intricate process of investment screening and analysis in private equity, which is now performed by skilled individuals. By compiling data from various sources, like financial statements, news articles, and industry reports, into a single, organized format, AI-powered solutions may automate the data aggregation stage.

After compiling the data, machine learning algorithms can spot trends like steady revenue growth and low debt levels that could indicate a lucrative investment opportunity. Using past data to project a company’s future financial performance or industry trends, AI is also essential to predictive analytics. Artificial intelligence (AI) can also evaluate the risks of possible investments by examining signs of financial trouble, such as falling sales or rising debt levels.

It can be difficult and time-consuming to find and assess possible investments in privately held businesses. Every time they evaluate the risks and potential rewards of a new investment, private equity firms are required to carry out a thorough due diligence procedure. Typically, this process includes analyzing a variety of facts, such as market trends, financial statements, and the performance of the target organization.

The due diligence procedure in artificial intelligence private equity can be greatly improved by AI private equity and technology. AI systems are able to analyze large volumes of data and recognize patterns and trends that may be challenging for human analysts to recognize, thanks to machine learning algorithms and natural language processing.

AI-driven predictive analytics leverage historical data and machine learning algorithms to forecast future market trends, asset performance, and investment outcomes. Private equity artificial intelligence firms can utilize predictive models to assess the risk-return profile of investment opportunities, optimize portfolio allocation, and make data-driven investment decisions that align with their investment objectives.

AI-powered analytics tools can assist in deal sourcing and origination by identifying potential investment targets based on predefined criteria and investment preferences. Natural language processing (NLP) techniques enable automated scanning of news articles, press releases, and regulatory filings to uncover potential deal opportunities and emerging market trends.

AI enables dynamic portfolio management by continuously monitoring and analyzing portfolio performance, market conditions, and macroeconomic factors. Machine learning algorithms can identify opportunities for portfolio rebalancing, asset allocation adjustments, and risk mitigation strategies in real-time, thereby optimizing portfolio returns and minimizing downside risk.

AI facilitates data-driven decision-making in exit strategy planning by analyzing market dynamics, competitor landscapes, and industry trends. Predictive modeling techniques help AI private equity firms anticipate optimal exit timing, identify potential buyers or exit channels, and maximize returns on investment through strategic divestment or initial public offerings (IPOs).

AI-powered risk management solutions enhance risk assessment and mitigation strategies by identifying and quantifying various types of risks, including financial, operational, and regulatory risks. Machine learning algorithms can detect anomalies, fraudulent activities, and compliance violations in real-time, enabling proactive risk management and regulatory compliance.

AI-driven investor relations platforms leverage data analytics and predictive modeling to personalize communication and engagement with investors. By analyzing investor preferences, behavior patterns, and historical interactions, private equity firms can tailor their fundraising strategies, pitch materials, and investment offerings to individual investor profiles, thereby enhancing investor relations and fundraising success.

AI Applications | Description |

|---|---|

Automated Screening & Due Diligence | Automates screening and analysis of investment opportunities, speeding up due diligence. |

Predictive Analytics | Uses historical data and algorithms to forecast market trends and optimize investment decisions. |

Portfolio Management | Monitors portfolio performance and market conditions for optimized returns and risk management. |

Deal Sourcing & Origination | Identifies potential investments and market trends through AI-powered analytics. |

Exit Strategy Optimization | Analyzes market dynamics for optimal exit timing and strategic divestment decisions. |

Risk Management | Identifies and mitigates financial, operational, and regulatory risks with AI solutions. |

Personalized Investor Relations | Customizes communication and engagement with investors for tailored fundraising strategies. |

The private equity sector is embracing AI-powered investment research products that were initially created for public market investors. One such platform is AlphaSense, an AI-driven investment research platform with over 800 clients that offers PE-specific data sources in addition to covering over 175,000 private companies. These improvements are helping to drive the increasing uptake of AI-powered investment research solutions in the PE industry, as is the ability of the majority of AI-based tools to integrate private data from PE companies. Benefits for early adopters include a capacity release of about 10% among investment professionals, which enables a larger investment funnel (more deals reviewed) at no extra expense.

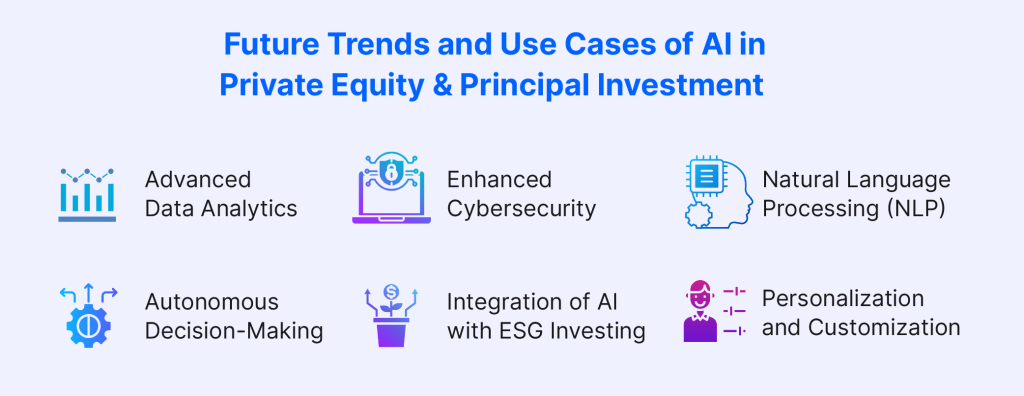

The future of AI in private equity and principal investment holds immense promise, poised to revolutionize traditional practices and unlock new opportunities for value creation and growth. In private equity and principal investment, AI languages facilitate efficient data analysis, risk assessment, and decision-making processes. As technology continues to evolve, several key trends are expected to shape the landscape of private equity and principal investment:

Future AI solutions will leverage advanced data analytics techniques, including machine learning and natural language processing, to extract valuable insights from vast datasets. These insights will enable investment professionals to make more informed decisions, identify investment opportunities, and optimize portfolio performance.

There is an increasing risk of cybersecurity vulnerabilities as AI is used more and more in private equity and primary investing. Through data analysis and real-time threat detection, artificial intelligence (AI) will improve cybersecurity in the future and allow investment professionals to react swiftly and efficiently to security breaches.

Natural language processing (NLP), which entails teaching machines to comprehend and interpret human language, is one of the most important developments in AI. Because NLP can process large amounts of unstructured data, such as financial news stories and social media posts, to uncover trends and patterns that may influence investment decisions, it can have a favorable impact on how primary investors and private equity firms examine and interpret financial data.

As AI algorithms get more complex, they will be able to make judgments on their own without human assistance. Given that algorithms can swiftly assess data and select investments based on predefined criteria, this might greatly increase the speed and efficiency of investment decision-making.

AI will play a pivotal role in integrating environmental, social, and governance (ESG) factors into investment decision-making processes. AI algorithms will analyze ESG data, assess sustainability risks and opportunities, and help investors align their investment strategies with ESG principles and goals.

AI-driven solutions will enable personalized and customized investment strategies tailored to individual investor preferences and objectives. By analyzing investor profiles, behavior patterns, and risk appetites, AI will facilitate the creation of bespoke investment portfolios and offerings that meet the unique needs of investors. Moreover, AI-driven recruitment platforms streamline the hiring process, reducing time-to-fill positions and optimizing workforce diversity. By leveraging AI in recruitment, firms can make data-driven decisions, attract top talent, and enhance overall organizational performance.

IntellicoWorks generative AI solution revolutionizes private equity and principal investment by harnessing the power of artificial intelligence to streamline processes, enhance decision-making, and maximize returns. With its advanced algorithms and data-driven insights, IntellicoWorks transforms various aspects of the investment lifecycle.

Firstly, IntellicoWorks automates investment screening and due diligence processes, enabling private equity firms to efficiently evaluate potential opportunities. By analyzing vast amounts of data from diverse sources, including financial statements, market trends, and industry reports, IntellicoWorks identifies high-potential investment targets and accelerates decision-making. AI development services encompass the creation, customization, and implementation of artificial intelligence solutions tailored to meet the specific needs and objectives of businesses and organizations.

Secondly, IntellicoWorks utilizes predictive analytics to forecast market trends and optimize investment strategies. By analyzing historical data and leveraging machine learning algorithms, IntellicoWorks provides actionable insights for portfolio management, asset allocation, and risk mitigation, enabling investors to make informed decisions that align with their investment objectives.

AI for private equity is revolutionizing investment decision-making by leveraging advanced data analytics and predictive modeling to optimize portfolio performance and identify high-potential investment opportunities. The way that main investment firms and private equity firms examine and interpret financial data has changed as a result of the application of artificial intelligence in these fields. Through the utilization of AI in decision-making, due diligence, operational efficiency, and portfolio management, primary investors and private equity companies can improve their performance and attain superior investment results.

Future developments in technology, including machine learning, natural language processing, autonomous decision-making, blockchain integration, and improved cybersecurity, should lead to improvements in the speed, accuracy, and efficiency of investment decision-making. It is crucial to remember that artificial intelligence (AI) does not take the place of human expertise, even though it offers substantial prospects for principle and private equity investment. Investment professionals need to make sure AI is utilized ethically and continue to apply their judgment and knowledge to make wise judgments.

Looking for AI Development Services? Elevate Your Business with Our Expertise!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.