When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

Innovation has always been a part of the financial industry, but the introduction of Artificial Intelligence (AI) is bringing about a change unlike anything seen in history. Artificial intelligence has become a game-changer in the rapidly changing financial technology sector, revolutionizing the ways in which we handle, invest, and communicate with our money. Combining AI and FinTech has created a synergy that brings revolutionary powers that were previously only found in science fiction together with the efficiency of standard financial procedures.

Fintech is a broad term that refers to the use of several digital technologies in the financial services sector. These days, the top five technologies that reflect the most significant developments in FinTech are artificial intelligence, cloud computing, blockchain, big data, and the Internet of Things. Because AI is so important to data analysis and process automation, it is conceivable that it has the widest range of applications among them.

Artificial intelligence’s capacity to work well with other digital technologies is one of its advantages. AI can now accomplish a far wider range of jobs thanks to this kind of cooperation. Because of this characteristic, artificial intelligence may now be used for a wide range of FinTech applications, including security, customer support, auditing, and many more.

Businesses of all kinds are looking for ways to use digital technology to streamline their operations. Artificial intelligence is a crucial component of digital infrastructure that is used in many financial operations. Naturally, the ultimate goal of AI-powered solutions is to boost business profitability by providing a variety of advantages and commercial prospects.

The benefits of using AI in the financial services business that are most widely accepted were found in a recent Statista study of 500 professionals in the field. The survey’s findings and a few more benefits that apply to FinTech are as follows:

Artificial Intelligence has found numerous applications in the FinTech sector, enhancing efficiency, security, and customer experiences. Here are some key AI use cases in FinTech:

AI algorithms analyze transaction patterns, user behavior, and historical data to detect anomalies and potential fraudulent activities in real-time, providing a proactive approach to fraud prevention.

Financial institutions don’t disclose the specifics of their security measures for obvious reasons. However, the majority of them would rather declare that artificial intelligence technologies are being used to stop fraud. By doing this, FinTech businesses deter possible criminals and draw in partners and customers. For instance, data processing systems using AI and ML are used by PayPal and Mastercard to detect potential fraud attempts and other questionable activity in real time.

AI-powered credit scoring models leverage diverse data sources to assess creditworthiness more accurately. This allows financial institutions to make faster and more informed lending decisions, expanding access to credit.

AI-driven chatbots and virtual assistants enhance customer service by providing instant responses to queries, guiding users through processes, and offering personalized financial advice. This improves customer engagement and satisfaction.

AI algorithms analyze market data, identify trends, and execute trades at high speeds, optimizing trading strategies. Machine learning models can adapt to changing market conditions and make data-driven investment decisions.

AI analyzes customer data, spending patterns, and financial goals to offer personalized advice on budgeting, investment strategies, and savings plans. This helps users make informed financial decisions aligned with their objectives.

AI assists financial institutions in navigating complex regulatory landscapes by automating compliance checks, monitoring transactions for suspicious activities, and managing risks associated with regulatory changes.

AI enhances the underwriting process in insurance by assessing risk factors, evaluating claims, and determining premiums based on a more comprehensive analysis of customer data, leading to more accurate pricing models.

AI-driven voice recognition and biometric technologies provide secure authentication methods, reducing the risk of unauthorized access to financial accounts and enhancing overall cybersecurity.

AI models use historical and real-time market data to predict investment trends, assess risks, and recommend investment opportunities. This assists investors in making more informed decisions.

AI helps in managing and analyzing vast amounts of customer data, allowing financial institutions to tailor their services, predict customer needs, and improve overall customer relationship management.

Even though AI-powered fintech solutions have demonstrated their dependability and capacity for advancement, several experts are worried about the associated ethical problems and difficulties. These issues restrict the potential applications of AI in FinTech and impede down further progress.

First and foremost, AI necessitates sufficient security because it involves collecting and storing vast volumes of data. Furthermore, since FinTech AI solutions have access to financial data, hackers may use them as a stand-in to steal that information.

Many AI algorithms, especially deep learning models, are often viewed as “black boxes” due to their complex structures. The lack of interpretability makes it challenging to explain the decision-making process, which is crucial, especially in financial services.

AI systems may inadvertently perpetuate biases present in historical data, leading to biased outcomes. This is particularly concerning in financial applications, where unbiased decision-making is crucial to ensure fairness in credit scoring and lending practices.

The dynamic regulatory landscape poses challenges for financial institutions and FinTech companies utilizing AI. Ensuring compliance with evolving regulations while navigating the complexities of AI implementation requires continuous monitoring and adaptation.

Integrating AI technologies with existing legacy systems in the financial sector can be challenging. Compatibility issues and the need for seamless integration often require significant investments and resources.

The absence of standardized practices and frameworks for AI in FinTech can lead to inconsistencies in development, deployment, and evaluation, hindering the industry’s ability to establish common benchmarks.

Most jobs are completed by artificial intelligence more quickly and effectively than by human labor. Some might view it as “job stealing,” which raises moral questions in light of the frequent spikes in the unemployment rate.

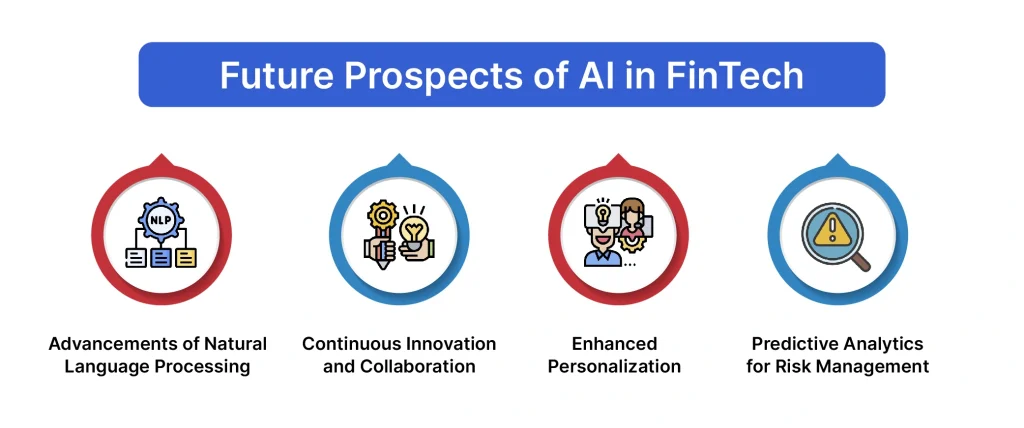

A plethora of use cases demonstrate how FinTech and AI are currently interwoven and will only become more so in the future. Artificial intelligence must continue to advance in order to maintain its effectiveness in all of its existing uses and find new, advantageous applications. The future of AI in FinTech will be shaped by the various encouraging trends listed below.

Engineers are currently tasked with making AI and human communication easier. Computers need to improve their ability to understand human languages, take context into account, and recall past conversations with each individual user in order to have meaningful conversations. Better speech recognition is just one way that the advancement of NLP technologies will give AI chatbots new capabilities.

The dynamic nature of both AI and FinTech ensures continuous innovation. Future prospects involve increased collaboration between FinTech startups, traditional financial institutions, and tech companies to pioneer novel solutions and stay ahead of industry trends.

AI algorithms will increasingly tailor financial services to individual needs, providing highly personalized experiences for users. This includes personalized investment advice, targeted financial planning, and customized product recommendations.

AI will play a crucial role in improving risk management through advanced predictive analytics. Financial institutions will leverage AI models to identify potential risks, anticipate market trends, and enhance decision-making processes for more effective risk mitigation.

Globally, artificial intelligence has already completely changed the financial sector and is still enabling it with new developments. There are many benefits for fintech companies that have either used AI or are contemplating it, some of which include increased security, automated critical operations, better forecasting and data analysis, and personalized client experiences. We specializes in providing modern AI development services, tailoring innovative solutions to meet the unique needs and challenges of businesses in the rapidly evolving tech landscape.

The integration of AI in FinTech is not merely a technological advancement; it represents a fundamental shift in how financial services are conceived and delivered. From personalized customer interactions to robust fraud prevention and advanced risk management, AI is at the forefront of driving innovation and efficiency in the finance industry. As we navigate this era of unprecedented technological progress, the synergy between AI and FinTech promises to redefine the landscape, creating a future where finance is not only smarter and more secure but also more inclusive and accessible to all. The journey has just begun, and the prospects for AI in FinTech continue to inspire a wave of transformative possibilities.

Transform Financial Operations With the Power of Artificial Intelligence!

Follow IntellicoWorks for more insights!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.