When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

AI credit repair is changing financial data handling by enabling precise identification and resolution of issues that affect credit scores. AI technology offers personalized strategies, which are essential for businesses and individuals who rely heavily on financial support. Remarkably, around 65% of small businesses depend on loans for their operations, underscoring the importance of maintaining a strong credit score. As we look to the future, AI in the credit score market showed rapid growth, with an expected CAGR of 26.5% from 2024 to 2029. This growth is due to advancements in machine learning and big data, which enhance the depth and accuracy of credit assessments. Such innovations are not only refining how creditworthiness is evaluated but are also expanding access to credit to a broader audience, including those with limited credit histories.

To understand more about how AI credit repair software can make 10x business credit scores, read the full article and get detailed insights into the burgeoning field of AI for credit repair.

When people do buying and selling and managing money, credit ratings are super important. AI credit repair reviews help people to see if a company is good at paying back the money it owes. These ratings are like a score that shows if a company is healthy with its money, just like grades show how well you’re doing in school. This score helps banks and other people who lend money decide if they think a company will pay back. It’s important because it helps companies grow bigger and do more business.

A maintained impressive credit score is not just beneficial for businesses but it’s essential.It opens many doors, enabling companies to achieve financial stability, capitalize on growth opportunities, and establish credibility within their industry. Here are some of the benefits of credit repair automation

Some key factors can help businesses manage their finances better and maintain a strong credit score for growth and stability. Below are the several key elements that determine a business’s credit score.

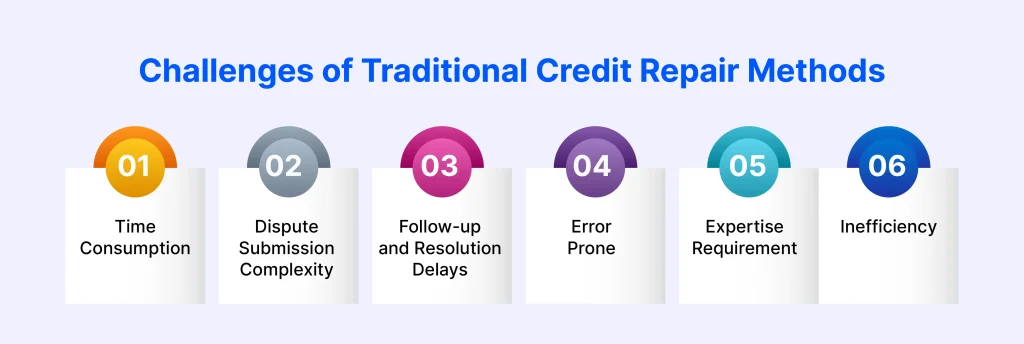

Traditional credit repair methods for businesses involve a series of manual, often cumbersome steps that can pose significant challenges:

AI in fintech is making huge tides with more and more applications being introduced like Artificial intelligence credit repair. According to a recent survey from BadCredit.org, 25% of participants say AI could help them improve their credit scores. Younger consumers are more likely to be early adopters of the AI technology, with nearly 40% believing it could be useful for this purpose. AI credit repair software is like a super tool for businesses looking to give their credit scores a massive 10x boost. This smart tech does a lot more than just tell you your score; it helps you make it better, fast! Let’s see how.

Personalized Credit Improvement Strategies: AI software isn’t one-size-fits-all. It looks at your specific business needs and offers tailored advice. If your business is young and your credit is new, AI might suggest different strategies than it would for a more established company. This personalized approach helps push your credit score up faster. A standout feature of AI credit repair software is its capability to develop personalized strategies for credit improvement. By analyzing a business’s credit history and financial behaviors, AI identifies areas for improvement and recommends specific actions to enhance credit scores. These strategies are tailored to each business’s unique situation, ensuring relevance and effectiveness.

Optimizing Dispute Resolution: Utilizing predictive analytics, AI credit repair software enhances the dispute resolution process. By evaluating historical data and outcomes, it can forecast the success rates of various dispute strategies, allowing businesses to focus on disputes that are more likely to succeed. This not only saves time but also increases the overall efficiency of the credit repair process, leading to quicker improvements in credit scores.

When you are choosing an AI credit repair software for your business, you need to see if it matches your specific needs and goals. Use this approach to making a well-informed decision:

Comprehensive Feature Assessment: Thoroughly examine the features provided by AI credit repair software. Essential features include dispute automation, continuous credit report monitoring, customized strategies for improving credit and receiving real-time updates. Opt for a solution that not only meets but enhances your business’s credit management efforts.

Security and Data Protection: Ensure the AI credit repair software you select incorporates stringent security protocols like data encryption, secure data storage, and adheres to industry standards such as GDPR or HIPAA. It’s also wise to check the provider’s track record in maintaining and protecting user data.

AI in business credit repair is revolutionizing the way companies enhance and manage their credit scores. Here’s a deeper look into what might lie ahead:

Credit Repair Automation is an advanced technology that saves valuable time and resources, ensuring the precision of credit reports, which is very essential for securing better loan terms and accessing additional capital. Intellicoworks is an AI development company that has been leading the charge for 10+ years in business, with 50+ industries explored and 500+ satisfied clients including BlackBird and NetBlaze. We provide AI development services and AI software development to streamline the complex process of credit management, enabling businesses to enhance their credit scores efficiently and accurately. We empower businesses to achieve robust financial health and success in a competitive marketplace. Our AI development can optimize your business operations and financial strategies like never before.

In summary, a robust credit score signifies reliability and trustworthiness in the financial world. For businesses aiming at long-term success and stability, leveraging AI in credit management is not just beneficial; it is essential. That’s why, AI for credit repair in business marks a significant shift towards more strategic, efficient, and personalized financial and investment management. As credit repair AI technology evolves, it not only refines the precision of credit analysis but also tailors this process to the unique demands of each business, ensuring a faster, more accurate approach to credit improvement. AI Credit Repair automation fosters enhanced financial health, opening up a myriad of growth opportunities in a competitive market landscape.

By choosing best credit repair software, businesses can transform a traditionally arduous task into a strategic advantage. This advanced approach to credit management minimizes manual errors and streamlines processes, allowing businesses to focus more on core activities and growth while maintaining optimal credit health effortlessly. As we look forward, the role of AI in this field is only set to deepen, promising a future where businesses can achieve greater financial health and stability with greater ease and precision.

Build the Future with AI - Start Your Journey with Expert AI Development Solutions!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.