When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

Traditional auditing and accounting companies relied on auditors to manage financial and accounting tasks manually. This manual approach was not only time-consuming but also prone to errors. However, AI is bringing a significant shift with automation towards digital transformation. As a result, businesses are increasingly adopting AI to set new industry standards. According to Spendesk, global spending on AI is expected to surpass $301 billion by 2026. Artificial Intelligence in accounting can enhance financial forecasting, fraud detection, and regulatory compliance effectively. Primeglobal reported the market of AI accounting valued at USD 1.17 billion in 2023. It is set to soar USD 4.96 billion by 2028. These stats show a great annual growth rate of 33.50% over the next five years. This is unbelievable, right?

This article will look at the impact of artificial intelligence on accounting and auditing. Moving beyond traditional methods can help you overcome challenges and discover new efficiencies. You will investigate real-world applications and best practices for incorporating AI into the accounting workflow. Let us explore the potential.

The need of today’s evolving landscape is to move accounting and auditing from traditional methods to a future where precision and efficiency are mandatory. The role of professional accountants is shifting towards more strategic impactful contributions with the addition of AI in their organizations. Artificial intelligence in accounting and finance can interpret and analyze text from contracts and internal notes which enhances analytical calculations by pinpointing anomalies like duplicate payments and fraud probabilities during financial statement audits. Here is a detail about how AI implementation in accounting can transform various aspects of auditing processes:

AI can process data accurately and continuously learn from past data, enhancing data analytics in the finance industry. AI-driven tools enable auditors to quickly process structured and unstructured data, detecting patterns, trends, and anomalies that warrant further investigation. This makes the audit process more thorough and insightful, enhancing the overall efficiency of the finance sector.

AI in accounting can streamline daily tasks by eliminating double efforts like transaction classification, data entry, and reconciliations, allowing accountants to focus on strategic roles. Artificial intelligence in auditing supports automating data collection, verification, and analysis, enhancing the quality of audits and allowing immediate detection of issues, ensuring accurate and reliable financial records. This real-time approach allows for more efficient and effective business growth.

Artificial intelligence (AI) in accounting can detect data anomalies, improve financial reporting integrity, and enable predictive analysis for financial forecasting. AI algorithms also enhance fraud detection by analyzing transaction data to identify potential irregularities, allowing auditors to focus on high-risk areas and improve the effectiveness of fraud detection.

NLP technology enables artificial intelligence algorithms to perceive and evaluate human language, which is helpful when auditing. As a result, auditors can gather relevant information from textual documents such as contracts and financial statements, thereby streamlining the data analysis process.

Integrating artificial intelligence and accounting can provide auditors with a data-driven approach to risk assessment. AI can help identify high-risk areas that require a closer look by utilizing historical data, industry trends, and financial ratios. As a result, auditors can better focus their resources, resulting in higher overall audit quality.

The AI predictive analytic feature can predict financial outcomes. It helps auditors assess management projections and identify potential financial issues.

Artificial intelligence in accounting can refine audit plans more effectively by profile analysis. It can also allocate resources by client data analysis and recommend customized AI auditing strategies.

AI can not only automate the review of a huge document volume but also enhance the speed and accuracy of the auditing process. As a result, large data sets and complex documentation can be managed shortly while auditing.

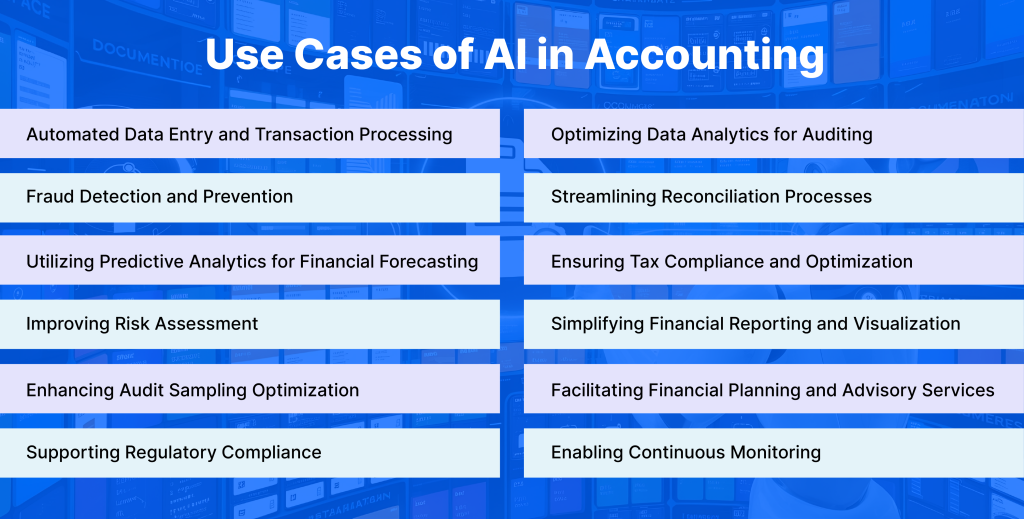

Artificial Intelligence has streamlined the way we process, analyze and audit financial data. In this section, we will explore some key use cases of AI in the field of accounting:

An auditor can streamline data entry and transaction processing with AI integration in accounting. There are significant technologies like optical character recognition that help AI to extract information from invoices and receipts and eliminate manual entry. As a result, it saves time for finance professionals. AI can also automate invoice matching, bank reconciliation, keeping financial records up to date and expense management.

AI algorithms can mitigate fraud by scrutinizing large transaction volumes for unusual patterns from established norms. This continuous monitoring by AI detects early fraud. As a result, financial integrity, bad organizational reputation and losses are protected.

Predictive analytics leverage AI to make the right predictions about a company’s future. AI do this by analyzing historical financial data and market insights. It can forecast critical financial metrics like revenue, expenses and cash flow. The insight helps businesses to generate a successful roadmap to the future.

AI uses algorithms to analyze data sources like historical financial records and market trends. This analysis helps organizations identify risks and impacts which enables businesses to mitigate risks proactively.

Artificial Intelligence in auditing can enhance processes by advanced data analysis techniques. AI tools can handle huge financial data to detect patterns and anomalies. As a result, it not only deepens the accuracy but also enables auditors to give more insights.

AI automates the financial record-matching process from sources like bank statements and internal databases. This automation eliminates manual efforts and increases accuracy. As a whole, organizations get a streamlined reconciliation process that ensures timely updates for financial records.

AI analyzes financial data to identify potential tax-saving opportunities. In this way, financial organizations reduce their tax liabilities legally. It also optimizes tax strategies by automatically calculating taxes based on intricate tax codes and evolving regulations.

With the duo of AI and accounting, you will get simplified financial reporting with enhanced data presentation using NLP and advanced analytics. AI can generate customized financial reports and visualizations automatically. As a result, complex data becomes easier to understand by stakeholders.

When applied in audit processes, AI can analyze extensive datasets. This analysis can identify areas that are at high risk of errors and irregularities. As a result, auditors can focus on improving the effectiveness of audits rather than focusing on extensive datasets.

AI robo-advisors can provide financial advice. They can plan and analyze client’s financial goals, risk tolerance and current situations. Because these services are automated, they enhance the accessibility of advice to make it more cost-effective and efficient.

AI continuously monitor and analyze data to make sure that an organization’s financial practices comply with the latest regulations or not. In this way, AI supports regulatory compliance and reduces the risk of costly violations.

AI in accounting can help organizations by providing real-time surveillance of financial transactions and systems. It can detect issues and provide proactive solutions to manage risk and compliance while ensuring integrity.

The fusion of AI and accounting brings a multitude of advantages efficiency, and accuracy in managing financial processes across organizations. Here are some of the improvements that are the result of AI integration in accounting and auditing as follows:

AI-driven automation reduces human error in data entry, calculations, and financial analysis. It also improves time efficiency by automating routine tasks like data entry, transaction matching, and reconciliation, allowing accountants and auditors to focus on strategic activities.

AI tools can perform advanced data management and analysis capable of handling large datasets and identifying trends. AI can also help in making informed decisions. They also provide real-time financial data that helps organizations respond quickly to changing financial conditions and make strategic adjustments.

Advanced AI algorithms help in fraud detection, forecasting future financial trends, and proactively managing challenges. They also enhance compliance with accounting standards and regulatory mandates, minimizing the risk of financial discrepancies and penalties. This technology aids organizations in identifying potential fraud and securing opportunities.

AI can streamline repetitive tasks and minimize manual intervention, while also allowing professionals to focus on strategic financial planning. AI can also be used for risk management and client relationship enhancement in auditing and accounting.

AI systems enable organizations to manage growing data volumes and transaction demands. They also enhance data security by continuously monitoring and identifying potential breaches or unauthorized access attempts.

AI offers strategic and operational advantages, including detailed audit trails, improved decision support, adaptive learning, and global accessibility. It simplifies the tracing and verification of financial transactions. It also enhances transparency and accountability and continuously evolves models to improve accuracy and effectiveness. Cloud-based AI solutions with remote access to financial tools and data facilitate seamless collaboration and decision-making from anywhere in the world.

AI has been used across industries for a long time now. Many companies have already implemented AI in their financial processes. They are real-life examples of AI in accounting. Let’s look at some real-world use cases of the biggest accounting firms in the world and learn the impact they’ve had on accounting processes:

Deloitte is an AI-powered document review platform. It automatically reviews client documents which is a tedious task if done manually. The platform uses cognitive technologies, machine learning, and natural language processing to interpret language, identify patterns, and identify key information. These underlined technologies significantly increased Deloitte’s contract review capacity by multiple orders of magnitude.

KPMG is the second most successful example of AI in accounting. It utlilizes AI for intelligent forecasting, enabling accountants to make more informed strategic decisions. This technology, which combines predictive modelling and advanced analytics allows for a more proactive approach to planning, budgeting, and forecasting. As a result, this advancement in AI for accounting has revolutionized the way businesses predict future trends and risks, enhancing their ability to make informed decisions.

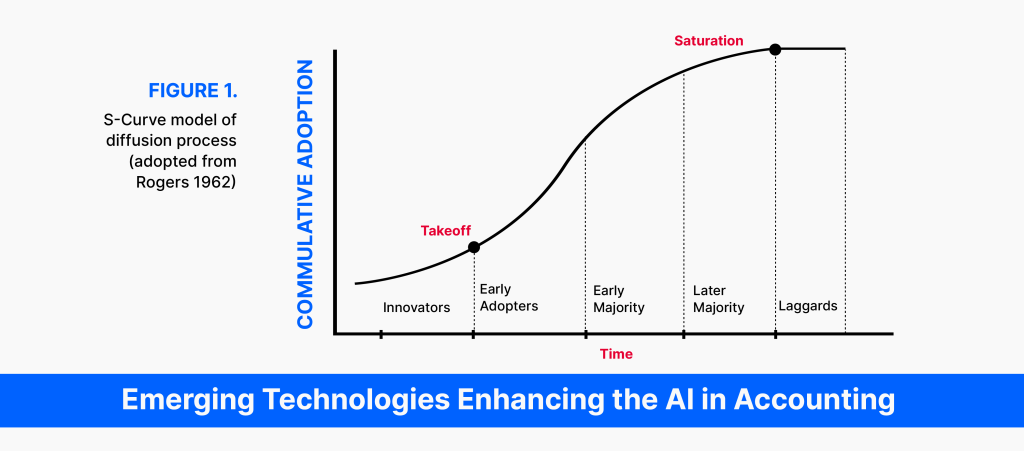

2023 has seen AI hit the mainstream, but the adoption in 2024 has shown some emerging technologies that are a part of this revolution. Here are some of the emerging technologies listed that are playing a role in enhancing the AI impact in accounting:

82% of financial businesses fail due to bad cash flow management, and businesses that leverage AI for accounting have a compound annual growth rate of 48.3% over the coming years. AI growth is significant for business. It is now or never if you want to stay competitive in the thriving age of AI. But, if you want to implement AI in the accounting business, you require a methodical approach that ensures successful integration for maximum benefits. Here’s a step-by-step guide to effectively deploy AI technologies within your financial operations:

First, define goals and objectives for AI implementation like efficiency enhancement, error reduction, and financial forecasting improvement. Then, identify use cases like transaction automation, fraud detection, financial forecast optimization, and risk management streamlining to maximize AI’s impact.

Start by collecting relevant financial data using various sources. Do strong research from authentic websites to gather accurate and comprehensive data to train effective AI foundation models.

Take security measures to safeguard sensitive financial information. Make sure that AI implementations comply with relevant industry regulations and standards like the General Data Protection Regulation (GDPR), to maintain the highest levels of data privacy and integrity.

Develop machine learning models that are customized for certain use cases, collaborate with data scientists and AI experts, and Then, continuously train these models on historical financial data, refining them as new data becomes available to improve accuracy and reliability.

Integrate AI technologies with existing financial and accounting systems like ERP platforms and financial management software. Then, ensure full interoperability and efficient data flow between AI solutions and legacy systems to maintain operational continuity.

You must conduct testing of AI models within a controlled environment to ensure accuracy and effectiveness. You should validate the models against various real-world scenarios to identify and address potential issues, ensuring readiness before full-scale deployment.

Lastly, implement mechanisms to maintain ongoing monitoring by AI systems to assess performance and identify areas for improvement. Do this by establishing regular maintenance schedules, updating protocols, and retraining models to adapt to new financial patterns and changes in regulatory requirements.

AI and ML are being used in various industries, mainly in accounting. It helps in budgeting and forecasting, corporate finance, and fraud detection. According to Spendesk, facts and figures, AI forecasting models can reduce errors to less than 5% and month-end reconciliation is 10 times faster. Additionally, 56% of financial services companies use AI for risk management, with machine learning algorithms achieving up to 96% accuracy. This is evidence that AI is transforming the role of the accountant from traditional number crunching to more analytical and advisory capacities.

This means the future of accounting jobs will depend on technology. If you are an accountant or an auditing company, it is important to be informed about the latest advancements like AI, machine learning, and blockchain. Continuous learning and adaptation are key to staying competitive in this landscape.

IntellicoWorks provides AI development services to mark a transformative leap towards accuracy and insightful financial management. By employing advanced tools and technologies, we set new standards in financial data processing and analysis ensuring client’s sustainable business and making our clients well-prepared to navigate the future of finance with confidence and insight.

As an AI development company, we leverage several AI technologies to align accounting tasks.

Artificial Intelligence (AI) in accounting and auditing elevates the standards of accuracy, efficiency, and strategic insight. AI automates complex and time-consuming tasks and allows financial professionals to focus on higher-value activities. This enhances productivity and reduces human error. However, AI in fintech enhances financial processes with advanced data analysis and pattern recognition capabilities to enable robust fraud detection and risk management. Businesses should encourage AI-driven systems for real-time insights and forecasting. With the right integration, businesses can anticipate financial challenges and adapt strategies quickly.

Strengthen Your Accounting Capabilities with Our AI Consulting Expertise!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.