1. ChatGPT

ChatGPT was launched in Nov 2022 and emerged as a strong contender in the AI for finance landscape. It leverages the power of natural language processing (NLP) to generate human-like, conversational text. This makes it a valuable tool for finance professionals who need to create content like blog posts or website materials conversationally and engagingly. Additionally, ChatGPT excels at brainstorming content ideas and sparking creative thought processes.

Features:

- Long-Form Conversational Text Creation: Provide ChatGPT with a simple prompt, and it can craft lengthy pieces of text that mimic natural conversation. This can significantly reduce content creation time for finance professionals.

- Content Brainstorming: Struggling for content ideas? ChatGPT can be a valuable brainstorming partner. Feed it a starting point or topic, and it will generate creative suggestions to get your content flowing.

Growth and Adoption:

The positive initial reviews suggest strong user adoption. According to a study by Exploding Topics, ChatGPT reached an estimated 180.5 million users by February 2024. This rapid growth is further emphasized in a report by Becker Friedman Institute which highlights that half of workers in exposed occupations (including finance professionals) have already begun using the technology. While long-term trends require further observation, ChatGPT’s initial impact on the AI for finance landscape appears significant.

2. Domo

Domo is a cloud-based data management platform designed to unify your business data from various sources. It provides a user-friendly interface for data visualization, allowing finance professionals to gain clear insights and tell data-driven stories. Domo’s ML capabilities further enhance the experience by automating tasks and offering data-backed recommendations.

Features:

- Data Integration: Domo seamlessly connects to diverse data sources, including CRM systems, ERP platforms, and financial databases. This eliminates the need for manual data consolidation and streamlines the data analysis process.

- Data Visualization: Domo boasts a vast library of pre-built dashboards and visualizations. Finance professionals can leverage these tools to create customized reports, charts, and graphs that effectively communicate financial information to stakeholders.

- Self-Service Analytics: Domo empowers finance teams with self-service analytics capabilities. Users can explore data independently, identify trends, and generate insights without relying on IT support.

- Machine Learning (ML): Domo integrates ML functionalities to automate repetitive tasks, predict future trends, and offer data-driven recommendations. This allows finance professionals to focus on strategic analysis and decision-making.

- Collaboration: Domo fosters collaboration within finance teams. Users can share reports, dashboards, and insights seamlessly, ensuring everyone is on the same page.

Growth and Adoption:

Domo has established itself as a leading player in the cloud BI market. Here’s a look at its growth and adoption trends:

- Market Recognition: According to a Gartner report, Domo was recognized as a leader in the 2023 Magic Quadrant for Cloud BI and Analytics Platforms. This recognition reflects Domo’s continued growth and industry acceptance.

- Industry Analyst Insights: Here’s a glimpse into what leading analyst firms are saying about Domo’s growth and adoption:

- McKinsey & Company: McKinsey’s 2023 report on “The Rise of Data-Driven Finance Functions” mentions Domo as a prominent example of a cloud BI platform enabling finance teams to translate data into actionable insights for better decision-making.

- EY and PwC: While specific reports from EY and PwC haven’t been identified here, both firms are acknowledged leaders in the financial services consulting space. Their focus on data-driven transformation aligns with Domo’s value proposition, suggesting they likely view Domo as a relevant solution for their clients in the finance sector.

3. Stampli

Stampli is first in AI and adaptability and has established itself as a leading provider of AI-powered AP automation solutions. Their platform streamlines the entire AP workflow, ensuring greater efficiency, accuracy, and control for finance teams. Moreover, Stampli’s AI captures and codes $50 billion in yearly invoices. And our products fully adapt to your ERP’s configuration.

Features:

- AI-Powered Data Extraction: Stampli utilizes AI to automatically extract data from your invoices, eliminating the need for manual data entry and minimizing the risk of errors. This significantly reduces processing time and allows finance teams to focus on more strategic tasks.

- Interactive Invoice Management: Boost collaboration and transparency within your team. Stampli allows for direct communication directly on invoices, fostering a more streamlined workflow.

- Real-time Audit Trails: Gain complete control over your financial operations with Stampli’s real-time audit trails. Every action taken on an invoice is monitored, providing valuable insights and ensuring accountability.

- Automated Workflows: Automate repetitive tasks like invoice approvals and payments, freeing up your team’s time for more complex work.

- Fraud Detection: Stampli’s AI capabilities can identify potential fraud by analyzing invoice data and flagging suspicious activity. This helps to protect your organization from financial losses.

Growth and Adoption:

While concrete data on Stampli’s user base or market share isn’t publicly available, several factors suggest its growth and adoption within the finance sector:

- Solving a Pain Point: Stampli addresses a common pain point for finance teams – inefficient AP processes. This value proposition positions them well for growth as companies seek to streamline their financial operations.

- Industry Recognition: Stampli has received positive recognition from industry publications and analysts. Here’s a glimpse into what leading research firms are saying:

- McKinsey & Company: McKinsey’s 2023 report on “The Rise of Data-Driven Finance Functions” mentions the growing adoption of AP automation solutions as a key driver of efficiency and improved financial controls. Stampli, as a leading provider in this space, is likely benefiting from this trend.

- Market Trends: The increasing adoption of cloud-based solutions and the growing focus on automation in finance create a favorable environment for Stampli’s growth. Businesses are actively seeking ways to streamline AP processes and improve efficiency, aligning perfectly with Stampli’s value proposition.

4. Vena Insights

Vena Insights is an embedded AI functionality within the Vena Complete Planning platform. It leverages powerful data visualization and AI capabilities to empower finance teams with deeper insights and a more strategic approach to financial planning and analysis (FP&A). It is a cloud-native solution for corporate performance management (CPM). Vena Insights empowers finance teams to go beyond basic data analysis by harnessing the power of:

- Embedded Power BI: Vena Insights leverages Microsoft’s industry-leading Power BI for advanced data visualization. This allows finance professionals to create interactive dashboards, reports, and charts that effectively communicate financial information to stakeholders.

- AI-Driven Insights: Vena Insights integrates AI capabilities to automate tasks, identify trends and patterns, and provide data-backed recommendations. This helps finance teams focus on strategic analysis and decision-making.

- Real-Time Data Access: Vena Insights ensures real-time access to all your financial data within the Vena platform. This eliminates the need for manual data consolidation and ensures everyone is working with the most up-to-date information.

Features:

- Self-Service Analytics: Vena Insights empowers finance teams with self-service analytics capabilities. Users can explore data independently, identify trends, and generate insights without relying on IT support.

- Scenario Modeling: Vena Insights allows finance teams to create and run various financial scenarios, helping them better understand potential outcomes and make informed decisions.

- Natural Language Processing (NLP): Vena Insights incorporates NLP capabilities, allowing users to ask questions and receive answers directly from their data using natural language. This simplifies data exploration and analysis.

- Enhanced Collaboration: Vena Insights fosters collaboration within finance teams. Users can share reports, dashboards, and insights seamlessly, ensuring everyone is on the same page.

Growth and Adoption:

The increasing complexity of financial data and the growing emphasis on data-driven decision-making in FP&A create a strong market need for solutions like Vena Insights.

- Research Report Statements: Gartner’s 2024 report on “The Future of FP&A: Embracing Automation and AI” highlights the growing demand for embedded analytics within FP&A platforms, aligning perfectly with Vena Insights’ value proposition.

- Strategic Partnerships: Vena’s partnerships with established players like Microsoft (Power BI integration) can further enhance its reach and adoption within the FP&A landscape.

- Vena Insights as Part of the Vena Complete Planning Ecosystem: Vena Insights’ tight integration with the broader Vena Complete Planning platform offers a comprehensive solution for all aspects of FP&A. This can be particularly attractive to organizations seeking a unified platform for budgeting, forecasting, and financial consolidation, potentially driving Vena Insights adoption alongside the broader Vena platform.

5. Macroaxis

Macroaxis is a wealth optimization platform that has established itself as a leading provider of AI-powered investment research tools. Their platform caters to individual investors, wealth managers, and financial institutions, offering a comprehensive suite of functionalities to support informed investment decisions.

Features:

- AI-Driven Insights: Macroaxis utilizes machine learning algorithms to analyze vast datasets of financial data, economic indicators, and market trends. This analysis helps identify potential investment opportunities and uncover hidden risks.

- Portfolio Optimization: Build and optimize diversified investment portfolios based on your risk tolerance and investment goals. Macroaxis’ backtesting capabilities allow you to assess historical performance and refine your portfolio strategy.

- Collaboration and Community: Connect and share investment ideas with other users on the Macroaxis platform. This fosters a collaborative learning environment and exposes you to diverse investment perspectives.

- Advanced Analytics: Macroaxis offers a robust set of analytical tools, including correlation analysis, idea breakdowns, and technical analysis indicators. These tools empower you to conduct in-depth research on potential investments.

- Accessibility: Macroaxis provides various pricing plans to cater to different investor needs. This makes their platform accessible to individual investors alongside professional wealth managers.

Growth and Adoption:

While specific user base data for Macroaxis might not be readily available, several factors suggest its growth and adoption within the investment research space:

- Democratizing Investment Research: Macroaxis lowers the barrier to entry for individual investors by providing AI-powered insights and advanced tools traditionally reserved for professionals. This approach positions them well for growth in a market increasingly focused on investor education and self-directed investing.

- Focus on User Experience: Macroaxis prioritizes a user-friendly interface and an intuitive design, making their platform accessible to investors of all experience levels.

- Market Trends: The growing popularity of online brokerage platforms and the increasing interest in self-directed investing create a favorable environment for Macroaxis’ growth. Investors are actively seeking tools and resources to make informed investment decisions, aligning perfectly with Macroaxis’ value proposition.

6. Trullion

Trullion offers a unique solution for accounting teams, particularly those focused on compliance and audit tasks. Trullion’s AI-powered platform can serve accounting and audit teams find unprecedented time savings, unparalleled growth opportunities, and flawless financial oversight. By leveraging AI to connect structured and unstructured data into a unified platform, Trullion empowers these teams to:

- Minimize Cost Inefficiencies: Streamlined workflows and automated processes can reduce manual effort and associated costs.

- Ensure Up-to-Date Compliance: Trullion facilitates easy access to all data sources, enabling efficient compliance checks.

- Save Time: Automating repetitive tasks like data extraction and report generation frees up valuable time for accounting professionals.

Features:

- Audit Function: Effortlessly compare transactions and supporting documents from any location, saving significant time during audits.

- Lease Contract Management: Extract key data from lease contracts of any format and generate audit-ready reports, eliminating manual data entry and ensuring accuracy.

- Revenue Collection & Reporting: Seamlessly connect CRM, billing, and contract data to automate workflows and streamline revenue recognition, accelerating the time to close.

Growth and Adoption:

- Market Need: The increasing burden of compliance and data management within accounting necessitates solutions like Trullion that automate tasks and improve efficiency.

- Positive Customer Reviews: User testimonials highlight significant time savings and improved workflow management with Trullion. A customer case study mentions a 40% reduction in workflow time with the potential for further savings.

7. Nanonets Flow

Nanonets Flow is an AI tool with OCR software designed to streamline finance tasks by automating complex processes and managing workflows.

Features:

- Automate Data Extraction and Organization: Nanonets Flow extracts and organizes important information from financial documents, reducing manual data entry and errors.

- Manage Workflows: Streamline and automate workflows to improve efficiency and reduce processing times.

- Integrate Financial Systems: Integrate existing financial systems with accounting software to create a unified workflow.

Growth and Adoption:

- Market Need: The growing volume of financial data necessitates automation tools like Nanonets Flow to streamline processing and improve accuracy.

- Focus on Efficiency: Nanonets Flow addresses the need for efficient financial operations, aligning with a key priority for finance teams.

- Customer Success Stories: Positive customer experiences can drive adoption as users see the tangible benefits of Nanonets Flow.

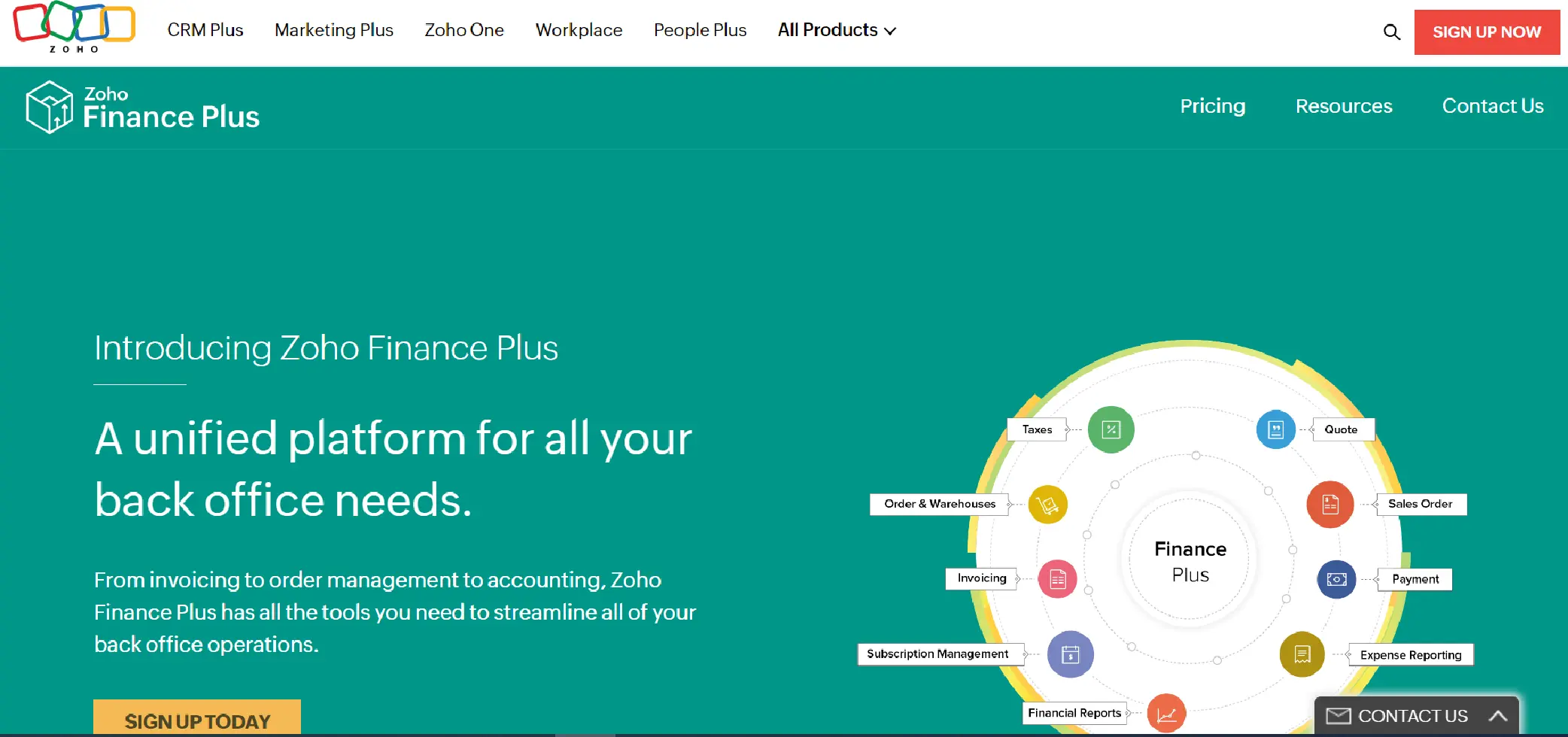

8. Zoho Finance Plus

Zoho Finance Plus is a unified platform for all your back office needs. From invoicing to order management to accounting, Zoho Finance Plus has all the tools you need to streamline all of your back office operations. It combines the functionalities of several popular Zoho applications geared towards financial management. This integrated suite caters specifically to the needs of various businesses, with a particular focus on service-based companies.

Features:

- Integrated Platform: Zoho Finance Plus seamlessly integrates Zoho Invoice, Zoho Books, Zoho Checkout, Zoho Expense, Zoho Inventory, and Zoho Billing into a unified platform. This eliminates the need to switch between separate applications for different financial tasks, streamlining workflows.

- CRM Integration: Zoho Finance Plus integrates tightly with Zoho CRM, creating a cohesive environment for managing customer interactions alongside financial processes. Users can manage contact information, generate invoices based on sales orders, and track payments, all within a single platform.

- Financial Management Tools: Zoho Finance Plus offers a comprehensive set of tools to manage all aspects of a business’s finances. These include:

- Accounting: General ledger, accounts payable & receivable, bank reconciliation.

- Invoicing: Create and send professional invoices, track payments, and manage customer accounts.

- Expense Tracking: Capture and categorize business expenses with ease.

- Subscription Billing: Manage recurring subscriptions and revenue effectively.

- Tax Compliance: Generate tax reports and ensure adherence to tax regulations.

- Subscription Management: Zoho Finance Plus caters specifically to service-based businesses with recurring revenue models. It allows users to manage subscriptions, track key metrics like Monthly Recurring Revenue (MRR), Average Revenue Per User (ARPU/A), and Lifetime Value (LTV).

Growth and Adoption:

- Market Need: The increasing number of service-based businesses necessitates comprehensive financial management solutions that cater to their specific needs. Zoho Finance Plus addresses this need by offering a bundled solution encompassing all aspects of financial operations.

- Integration Advantage: The tight integration with other Zoho applications, particularly Zoho CRM, creates a significant advantage for businesses already invested in the Zoho ecosystem.

- Scalability: Zoho Finance Plus offers tiered pricing plans, allowing businesses of various sizes to access the functionalities they need at a suitable cost point. This can contribute to wider adoption across different business scales.

9. Datarails

Datarails is a powerful AI-powered tool specifically designed to assist finance professionals with financial planning and analysis (FP&A) tasks. By leveraging cutting-edge artificial intelligence, Datarails FP&A Genius empowers finance teams to streamline workflows, improve data accuracy, and gain deeper insights for informed decision-making.

Features:

- Real-Time Data Connection: Datarails FP&A Genius eliminates data latency issues by connecting to real-time data sources. This ensures finance professionals are always working with the most up-to-date information, leading to more accurate analysis and reporting.

- Unified Data Source: FP&A Genius acts as a central hub, consolidating data from various financial systems and applications into a single platform. This creates a “source of truth” for financial data, eliminating discrepancies and streamlining data management.

- Secure and Trustworthy: Datarails prioritizes data security and ensures information retrieved by FP&A Genius comes from trusted and reliable sources. This provides finance teams with peace of mind and fosters confidence in the data-driven insights generated by the tool.

- Visualization Tools: Datarails FP&A Genius doesn’t just provide raw data. It also offers built-in visualization tools to create insightful dashboards and reports. This allows finance teams to effectively communicate complex financial information to stakeholders.

Growth and Adoption:

- Market Need: The growing complexity of financial data necessitates tools like Datarails FP&A Genius that can automate data consolidation, ensure accuracy, and provide real-time insights. FP&A Genius addresses this need by offering an AI-powered solution that streamlines FP&A processes.

- Focus on Efficiency: Finance teams are constantly under pressure to do more with less. FP&A Genius helps by automating time-consuming tasks like data gathering and cleaning, freeing up valuable time for analysis and strategic decision-making.

- Improved Decision-Making: By providing real-time data and insightful visualizations, FP&A Genius empowers finance professionals to make data-driven decisions that can significantly impact a company’s financial performance.

10. Planful Predict

Planful Predict is an AI-powered software platform designed to assist financial planning and analysis teams and CFOs in making faster, more accurate financial decisions. It eliminates the need for manual data analysis and reporting, allowing finance professionals to focus on strategic planning and insights generation. Planful Predict checks for errors, identifies patterns, and provides intelligent forecast recommendations using a natively integrated AI engine, enhancing the efficiency and accuracy of financial decision-making.

Features:

- AI-Driven Insights: Planful Predict leverages artificial intelligence (AI) and machine learning (ML) algorithms to analyze vast datasets of financial data, economic indicators, and market trends. This analysis helps identify potential financial performance issues, uncover hidden opportunities, and generate data-driven forecasts for better decision-making.

- Data Integration Advantage: Planful Predict builds upon the core strength of FP&A platforms – data integration. It seamlessly integrates with existing financial systems and applications, ensuring all relevant data is readily available for analysis by the AI engine. This eliminates the need for manual data consolidation and reduces the risk of errors.

- Focus on Weaknesses: Unlike some AI tools that offer a broader range of visualizations, Planful Predict prioritizes identifying potential weaknesses in a company’s financial health. It employs a feature called “Predict: Signals” which utilizes AI-driven anomaly detection to pinpoint variances and outliers in financial data. This allows finance teams to proactively identify and address potential issues before they escalate.

Growth and Adoption:

- Market Need: The increasing volume and complexity of financial data necessitates AI-powered tools like Planful Predict. It helps FP&A teams unlock valuable insights from data, streamline workflows, and improve the accuracy of financial forecasts, addressing a key need within the finance sector.

- Focus on FP&A Professionals: Planful Predict is specifically designed for FP&A teams and CFOs, aligning with the growing demand for AI-powered solutions tailored to the needs of financial planning and analysis professionals.

- Integration with Existing Platform: Planful Predict’s integration with the established Planful FP&A platform could be a significant advantage. Existing Planful users might be more likely to adopt Planful Predict due to its seamless integration within their familiar workflow.

11. Vic.ai

Vic.ai is an advanced AI platform that optimizes invoice processing and bill pay, achieving 5x ROI and 80% higher AP efficiency, enabling informed decisions and lasting ROI in accounting and finance. It leverages advanced machine learning algorithms to automate a significant portion of the billing process, transforming how businesses handle their invoices. Vic.ai is particularly well-suited for larger companies grappling with high volumes of invoices.

Features:

- Automated Invoice Processing: Vic.ai excels at extracting key invoice details like vendor information, line items, and total amounts, reducing manual data entry and saving valuable time.

- Duplicate Detection: Vic.ai’s AI capabilities can identify duplicate invoices, preventing errors and ensuring accurate financial records.

- Streamlined Approval Workflow: Vic.ai facilitates a smoother invoice approval process by automating routing and notifications, minimizing delays and improving efficiency.

- Reduced Errors: By automating data extraction and reducing manual intervention, Vic.ai minimizes the risk of errors in invoice processing, leading to more accurate financial data.

- Improved Cash Flow Management: Faster invoice processing and approval cycles facilitated by Vic.ai can lead to quicker payments to vendors and improved cash flow management.

Growth and Adoption:

- Market Need: The growing volume of invoices necessitates automated processing solutions like Vic.ai. It addresses a key pain point for businesses struggling with manual invoice processing tasks.

- Improved Efficiency: Vic.ai streamlines invoice processing, leading to significant time savings and improved operational efficiency. This resonates with businesses seeking to optimize their financial processes.

- Reduced Errors: The AI-driven approach to invoice processing minimizes errors and ensures data accuracy, a critical aspect for financial management.

12. Microsoft Copilot

Microsoft Copilot is an AI-powered ai assistant that integrates seamlessly with Excel to supercharge its capabilities. Copilot leverages the power of Generative Pre-trained Transformer (GPT) technology to provide users with advanced data analysis tools directly within their familiar Excel environment.

Features:

- Advanced Data Analysis: Copilot empowers users with functionalities beyond basic Excel features. It offers tools for complex data analysis, including trend identification, correlation analysis, and anomaly detection.

- Predictive Analytics: Copilot utilizes AI to generate data-driven forecasts, allowing users to make more informed predictions about future outcomes. This is particularly valuable for tasks like financial modeling, budgeting, and scenario planning.

- Formula Building Assistance: Copilot can understand user intent and provide assistance with building complex formulas. This simplifies data manipulation and analysis for both new and experienced Excel users.

- Chart and PivotTable Creation: Copilot streamlines the process of creating insightful charts and pivot tables from data. Users can leverage AI suggestions for data visualization best practices.

- SQL Query Assistance: For users working with data stored in databases, Copilot can assist with writing SQL queries for data retrieval.

Growth and Adoption:

- Market Need: The increasing demand for data-driven decision-making necessitates tools like Copilot that empower users to extract deeper insights from their data within Excel, a widely used spreadsheet application.

- Enhanced Excel Capabilities: Copilot significantly expands the capabilities of Excel, making it a more powerful tool for data analysis, forecasting, and financial modeling. This can attract new user segments and drive adoption.

- Seamless Integration: Copilot’s integration within the familiar Excel environment minimizes disruption to existing workflows, making it easier for users to adopt and leverage its functionalities.

13. ClickUp Billing and Finance

ClickUp isn’t just a project management tool; it offers a comprehensive suite of features for managing your business finances within a single platform. ClickUp Billing and Finance combines accounting software functionalities with AI-powered automation and insightful reporting to simplify financial processes and empower informed decision-making.

Features:

- ClickUp Accounting: ClickUp offers a cloud-based accounting solution for managing accounts, creating reports, and tracking financial data.

- ClickUp Brain: This AI-powered virtual assistant utilizes natural language processing to handle tasks like summarizing financial meetings, generating reports, and updating forecasts. ClickUp Brain helps users focus on strategic planning by automating routine tasks.

- ClickUp Docs: Create and customize spreadsheets for financial tasks using ClickUp Docs. Leverage pre-built templates like the ClickUp Accounting Template for managing invoices, expenses, income, and revenue forecasts.

- Streamlined Workflow Integrations: ClickUp integrates with over 1,000 business tools, allowing seamless data exchange and keeping everything centralized within a customizable dashboard.

Growth and Adoption:

- Market Need: Businesses seek integrated solutions that streamline financial processes and provide data-driven insights. ClickUp Billing and Finance caters to this need by offering a comprehensive platform with automation tools.

- Focus on User Experience: ClickUp prioritizes user experience with customizable dashboards, pre-built templates, and readily available video tutorials, promoting wider adoption.

- Scalability and Affordability: Tiered pricing plans cater to businesses of various sizes, making ClickUp Billing and Finance an attractive option for companies seeking to grow their financial management capabilities.

14. Bill.com

Bill.com is a cloud-based solution specifically designed to automate accounts payable (AP) and accounts receivable (AR) processes. It caters to accounting firms and businesses seeking to streamline billing, invoicing, and payment workflows. Bill is the intelligent way to create and pay bills, send invoices, manage expenses, control budgets, and access the credit your business needs to grow all on one platform.

Features:

- Automated Bill Payments and Approvals: Bill.com utilizes smart rules and workflows to automate routine tasks like bill payments and invoice approvals, reducing manual work and improving efficiency.

- Enhanced Spend Control: Bill.com provides real-time insights into spending across teams, projects, and departments. This allows businesses to monitor expenses and optimize budgeting strategies.

- Divvy Integration: Bill.com integrates with Divvy, a credit and expense management platform. Divvy offers lines of credit and tools to manage spending and budgets, adding further value to the Bill.com solution.

- Multi-Client Management: Bill.com simplifies managing AP invoices, approvals, and payments for multiple clients within a centralized platform.

Growth and Adoption:

- Market Need: Businesses are constantly seeking ways to improve efficiency and gain greater control over their finances. Bill.com addresses this need by providing an automated solution specifically focused on AP and AR processes.

- Focus on Automation: Bill.com prioritizes automation, reducing manual work and streamlining workflows, which resonates with businesses seeking to free up resources for strategic tasks.

- Enhanced Collaboration: Bill.com facilitates smoother collaboration between accounting teams and clients through centralized invoice management and approval processes.

15. Booke.ai

Booke AI is an AI-powered digital voice assistant that is a bookkeeping solution designed to automate and simplify the accounting process for small businesses. It addresses the common pain points of manual bookkeeping, offering a seamless and efficient way to manage financial records and ensure accuracy.

Features:

- AI-Powered Transaction Categorization: Booke AI uses advanced AI algorithms to automatically categorize transactions, reducing the time and effort needed for manual entry and ensuring consistency in financial records.

- Two-Way Integrations with Accounting Tools: The platform integrates smoothly with popular accounting tools, allowing for easy data synchronization and minimizing the risk of errors during data transfer.

- Inconsistency and Error Detection: Booke AI identifies and flags inconsistencies and errors in your financial data, helping to maintain accurate records and avoid costly mistakes.

- Invoice and Receipt Optical Character Recognition (OCR): The OCR technology in Booke AI enables quick and accurate digitization of invoices and receipts, streamlining the process of data entry and storage.

Growth and Adoption:

- Market Need: Small businesses are increasingly looking for efficient ways to manage their bookkeeping without dedicating extensive time and resources. Booke AI addresses this need by providing an automated, user-friendly solution.

- Focus on Automation: By prioritizing AI-driven automation, Booke AI resonates with businesses seeking to minimize manual tasks and enhance the accuracy of their financial records.

- Streamlined Financial Management: Booke AI’s comprehensive features facilitate smoother financial management, allowing businesses to maintain accurate records and generate reliable reports with ease.