When teams operate independently, it creates communication gaps that can lead to disorder. In contrast, when teams collaborate, they tend to be more efficient.

Successful investment management involves a deep understanding of market trends, the ability to process large amounts of data, and the flexibility to make fast decisions. Traditionally, this attempt was highly dependent on human skill and was relatively costly.

However, the incorporation of AI-powered solutions has changed the way investment decisions are made. AI systems can process massive datasets from various sources at remarkable speeds and precision. Furthermore, they can evaluate large amounts of organized and unstructured data, providing a comprehensive view of the marketplace.

Here, we look at AI in the investment management industry, its advantages, and the challenges it has to surmount in order to gain the edge.

Artificial intelligence refers to the capability of a machine to conduct tasks normally done by a human being. In investment management, AI facilitates improved decision-making procedures, portfolio optimization, and enhancing customer service delivery. From high-speed algorithmic trading systems to superhuman predictive machine learning models forecasting market trends and analyzing investment risks, AI is everywhere in the deployment.

Asset and wealth managers face challenges like increased passive investments, reduced investment fees, and uncertainties about the future.

In the past decade, asset and wealth managers have seen tremendous change affect their business models. Fee pressure, for instance, has led to an all-out price war and the move to passive investment has put active managers on the defense. In such situations, artificial intelligence, machine learning (ML), and data analytics technologies have helped bring positive change.

AI, ML, and natural language processing (NLP) are offering efficient solutions on both fronts – the need to generate alpha and the need to contain costs.

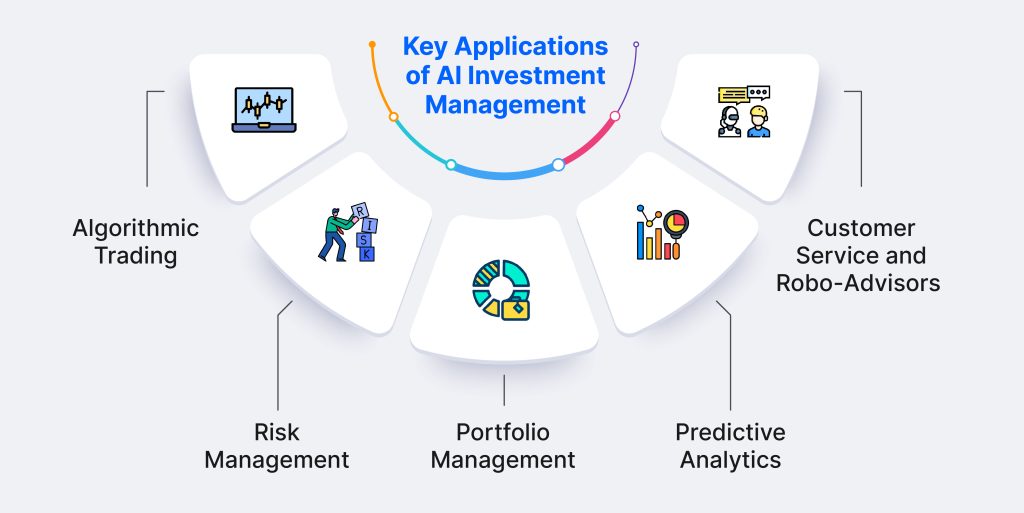

Encapsulates the pivotal roles that artificial intelligence plays in modern investment practices. From algorithmic trading, where AI swiftly identifies trading opportunities, to risk management, where it detects subtle market anomalies, AI revolutionizes portfolio management by optimizing asset allocation. Moreover, AI-driven chatbots and robo-advisors provide seamless customer service, while predictive analytics forecast market trends with unparalleled accuracy.

One of the most highlighted applications of AI in investment management is algorithmic trading. AI-enabled algorithms help analyze large sets of data, determine trading opportunities, and take up trades much faster than human traders.

These algorithms use historical data and complex mathematical models to make predictions about market movements.

Faster and more accurate analyses make AI an able assistant in risk management. Machine learning models are capable of detecting unnoticed risk factors and market anomalies by human analysts. The ability to always take the best possible preventative actions against eventual risks is hence supplied to the managers.

It is also revolutionizing the way of portfolio management. AI provides the manager with tools to optimize not only the asset allocation process but also diversification. AI may suggest which may be the convenient strategies for investment, analyzing the market conditions, the profile of the investor, and economic indicators, to decide upon them.

Investment predictive analytics form an important tool in coming up with trends likely to be taken up by the markets and investors’ behavior in the future. AI models process massive information, which includes sentiment from social media, economic reports, and political events in an attempt to predict shifts taking place in the market.

Presently, AI-based chatbots and robo-advisors are replacing the conventional communication bridge between investors and their investment managers. The tools offer almost full customer service, from a 24/7 service perspective, which was never possible.

Artificial Intelligence investment management has revolutionized numerous industries, and investment management is no exception. Its application in this field has brought forth a myriad of benefits, transforming the way investments are analyzed, managed, and optimized.

AI-powered robo-advisors make investment recommendations and professional portfolio management accessible to a broader range of people. They typically charge lower fees compared to human financial advisors.

This tool is aimed to cater to investors’ specific financial goals and offer tailored advice based on their needs. A robo-advisor takes into account risk tolerance, desired timelines, and other relevant factors to ensure expenses align with the client objectives.

Investment firms are bound by laws and regulations set both by government authorities and regulatory bodies. And as we know, staying compliant with legislation can foster trust and confidence in the financial industry. Needless to say, it can spare you of severe penalties.

AI algorithms ensure timely submissions to regulatory authorities. For example, in asset management and portfolio monitoring, artificial intelligence can automate the process of generating legal reports and filings. It often requires complex calculations and data aggregation, which can be error-prone when done manually, and the use of AI reduces the risk of mistakes and streamlines the entire process.

The last significant benefit we would like to cover is the capability of AI algorithms to continuously learn and adapt. They can analyze both historical and real-time market data.

Consequently, these algorithms are able to learn from the latest trends and patterns like new data, experiences, and feedback. It allows them to continually improve their performance and adapt to changing market conditions. Thus, they can provide more accurate information for successful investment management.

Artificial Intelligence has come a long way, but it still has a long way to go. Similarly to human beings — finally, something in common, it’s not perfect and can fail sometimes. The wisdom says, “Measure twice, cut once.” So, before implementing AI in your products, consider some possible challenges you can face.

We’ve already mentioned that artificial intelligence relies on historical data to provide some insights. The incompleteness and inaccuracy of this data can lead to flawed predictions and decisions. Therefore, data quality control and validation processes are essential to ensure the reliability and effectiveness of AI-driven investment strategies.

It’s important to establish comprehensive data quality management and data governance processes to solve possible issues with incorrect data. Before implementing data into AI systems, you should identify and fix any inaccuracies or gaps.

Sometimes it can be difficult to explain how AI works and makes predictions. Many artificial intelligence algorithms, such as deep learning neural networks, can be hard to understand. Therefore, keeping the AI-powered investing transparent and clear for clients is crucial.

This way, businesses can foster trust with customers and improve their engagement with the financial tools.

With the rise of AI in various domains, ethical concerns become an increasingly prominent topic of discussion. Indeed, ethics and morality are human features, not machines.

One of the key considerations here is the potential for AI to outsmart humans. Superintelligent technology could act against human values and interests if not properly controlled. While this concern remains more of a hypothetical one, another made its way to reality.

Probably, many of us remember the case when Amazon started to use artificial intelligence to scan job applications, but as a result, it downgraded female candidates. This happened because it relied on historical data, which showed that Amazon had been a male-dominated work environment.

So it is worth carefully selecting the information you are going to train your AI with and pay attention to these kinds of ethical concerns.

Today more and more businesses recognize the potential of artificial intelligence, and its incorporation in investment management platforms has become an increasing trend. With that in mind, let’s see how companies leverage AI in their solutions.

Investment industry is a tough one, which makes portfolio management a complex endeavor too. However, with AI assistance, you can succeed in this scope.

Typically, computer algorithms analyze market data, determine risks, and find asset classes that potentially give the highest returns. It helps forecast the future price of financial holdings. So, with AI at its core, portfolio management has entered a new era of efficiency and accuracy. It empowers investors to make data-driven decisions and achieve enhanced performance.

Probably client retention is on the top priorities for businesses. That is quite right, because without loyal customers it can be challenging to ensure your company’s long-term success.

AI technologies can help you improve your client retention program. They may detect at-risk clients and give your insight about their preferences. Thus, making it possible to offer users unique investment solutions aligned with their needs.

Businesses can improve the security and trustworthiness of their payment transactions by deploying AI-powered tools to protect their financial solutions.

For example, algorithms of artificial intelligence can analyze transaction data in real time, detect unusual patterns, and prevent potential fraud. They can also identify anomalies that might signal security breaches or cyberattacks.

Future of AI in investment management is brilliant, but it requires a careful path. With its development, new technologies are emerging for implementation strategies. In fact, those firms able to integrate AI technologies successfully into operations might have a competitive advantage for the ability to offer improved returns and customer services.

Among the groundbreaking trends of artificial intelligence, GenAI stands tall. One of its notable innovations is the Generative Pre-Trained Transformer (GPT). It can understand and generate human-like language across a wide range of tasks. No doubt, you are already familiar with the talk of the town — ChatGPT.

Armed with the capability to draw insights and offer recommendations from extensive datasets, ChatGPT can provide information on various investment-related topics. However, it is better not solely base your decisions on the information provided by AI algorithms.

As we have already mentioned, AI technologies are trained on historical data. Consequently, in some cases, it is prudent to verify the accuracy and credibility of the information offered by the GPTs.

Voice authentication is gaining popularity as a secure and convenient method of access. Investment firms can leverage voice technologies for enhanced data security by implementing it as an alternative to traditional passwords or PINs in their login processes. This approach is actively used in investment applications, thus protecting user data and safeguarding sensitive financial information.

Voice technologies have other benefits too. For example, they allow investors to execute trades using voice commands through voice-enabled platforms. This feature can be particularly useful in fast-paced markets, where speed is essential.

It is also possible to receive concise news summaries and sentiment analysis through voice technologies. Such analysis can gauge market sentiment and identify potential impacts on stock prices.

Although AI is a subject that is frequently discussed due to its potential, not everyone is familiar with how it functions. Describing the process of developing artificial intelligence models and algorithms to maximize business benefits is not always easy.

Here is where explainable AI comes into play. It aims to offer transparency and interpretability to AI systems. In this way, it allows clients to trust and grasp the rationale behind the AI’s predictions or recommendations.

The future of wealth management with AI is promising. The algorithms can analyze vast amounts of financial data and market trends, enabling companies to develop sophisticated investment strategies. As a result, this allows wealth managers to offer personalized and optimized portfolio recommendations tailored to each client’s financial objectives and risk appetite.

Artificial intelligence has revolutionized the financial industry. It enables the processing of large data volumes to derive valuable insights for building robust investment strategies. After we discussed so many benefits and future trends that are going to transform this field, you are probably eager to embrace AI in your business.

AI will revolutionize the paradigm under which investment management is placed today. There are challenges to its broad use, but the potential benefits of more efficiency, accurate decision-making, and personalized services are indicative that AI will be integrated into this sector. AI’s future evolution is fated to increasingly become more of a central factor than ever in the shaping of the future of investment management. It will, therefore, take hands that are capable technologically, bearing in-depth understanding of regulatory and ethical implications, to deploy AI successfully. Investment managers, therefore, have to navigate those waters in a way that allows them to fully tap into the potential technology offers but not to jeopardize operations built upon trust and integrity at the same time.

Transform Your Business with Cutting-Edge AI Development Services Today!

Talk to us and let’s build something great together

A Subsidiary of Vaival Technologies, LLC

IntelliCoworks is a leading DevOps, SecOps and DataOps service provider and specializes in delivering tailored solutions using the latest technologies to serve various industries. Our DevOps engineers help companies with the endless process of securing both data and operations.

Ops

Cloud

AI & ML

Copyrights © 2023 byIntellicoworks. All rights reserved.